Performance overview

This performance overview provides a summary of our purpose, the outcomes we aim to achieve, and the key challenges and risks that we face.

Statement from the Chair

I am pleased to present our annual report for 2022-23, the second year of the 2021-27 regulatory control period. The final determination of charges for the 2021-27 period set out the charges

necessary to protect current and future generations of customers’ access to high quality, resilient water services. The determination allowed for further investment by Scottish Water to adapt to climate change as it moves towards its 2040 net zero emissions target.

Last year, in the backdrop of the challenging economic environment, we began working with Scottish Water to understand how it plans to manage costs, revenue and charges during the remainder of the regulatory control period and likely impact on current and future customers. This important work will continue into the remainder of 2023 and will impact the way we monitor and report on Scottish Water’s performance moving forward.

During the year we continued work to develop our approach for the next strategic review of charges, learning lessons from our experience during the 2021-27 Strategic Review of Charges and these first years of the regulatory control period.

This year, in our work to support the Scottish Government’s Hydro Nation initiative, we have supported colleagues in New Zealand as they embark on a journey to reform their own water industry. Our employees benefited hugely from the learning and experience gained working in New Zealand and with a wide range of international partners.

Collaboration is an important aspect of the Scottish water industry and as such, I look forward to building on our already productive relationships with stakeholders both at home and abroad.

On behalf of WICS’ Board, I would like to thank the Chief Executive and staff for their commitment this year; it has been a great pleasure to work together. Finally, I would like to welcome Alex Plant to his new role as Chief Executive of Scottish Water. We look forward to working with Alex as he leads Scottish Water in its transformation to secure a sustainable future for the industry.

Professor Donald MacRae OBE FRSE Chairman

December 2023

Summary performance statement from the Chief Executive and Accountable Officer

I am pleased to present our annual report and to provide a summary of our performance for 2022-23. Our objective at all times is to establish the best outcomes for water and wastewater customers, communities, and the Scottish environment – an approach firmly rooted in doing what is right for both current and future customers. Our decisions are within the context of the Scottish Ministers’ objective to transition to a net zero carbon industry by 2040 and to ensure the sustainable long-term future of the water industry.

Our key achievements this year in delivering our strategic objectives are summarised here, with more detailed information provided in the sections that follow.

Supporting the sector vision and ministerial objectives

Our first strategic objective is to support the sector to achieve its long-term vision and to deliver the Scottish Ministers’ Objectives for Scottish Water.

This year was the second year covered by our final determination for the 2021-27 regulatory control period, which was published in December 2020. The determination considered the Ministers’ final objectives for the industry and their Principles of Charging. It allowed for the investment necessary to improve water quality and the environment and to support economic growth. The determination outlined the need for a long-term, sustainable and innovative approach to replacing Scottish Water’s assets.

In SRC 21-27 we recognised that levels of investment would have to increase significantly over the next two decades if the industry were to replace its aging assets and maintain levels of service in the face of climate change. As such, we set out our expectation that Scottish Water take ownership of a clear, well-defined strategy that covers what it plans to achieve in the short, medium and long term. Specifically, we expected Scottish Water to provide a clear picture of the future investment that could be required and an assessment of the likelihood and timing of this investment.

Throughout the SRC21 process, the industry recognised that addressing future challenges would involve a significant transformation of Scottish Water’s business including taking early steps to develop the required organisational capabilities to prepare its strategy. This year, we have continued to work with Scottish Water as it begins to take some of the initial steps to transform its business.

Our final determination allowed for an average annual price change of 2% in real terms each year to facilitate Scottish Water’s transformation. It has become clear that the cumulative price increase over the 2021-27 regulatory control period will not now be realisable. We have asked Scottish Water to prepare financial scenarios based on different combinations of price profiles, borrowing levels and time horizons. In August 2022, we received an initial information submission from Scottish Water and further work is ongoing to provide clarity over what can and cannot be delivered during the remainder of this regulatory control period.

Best in class levels of services

Our second strategic objective is to challenge Scottish Water to achieve best in class levels of service for its customers and communities. It is important that Scottish Water maintains a ‘laser like’ focus on its strategic prioritisation of investment and is able to take full account of the

benefits and costs over the long-term when it undertakes its investment appraisals. This approach will help ensure best value for money for current and future customers.

Towards the end of the financial year, we published our report of Scottish Water’s performance for 2021-22, the first year of the new regulatory control period. The report noted that whilst Scottish Water has broadly maintained its performance, there does appear to be some slippage in the delivery of its investment programme.

Alongside our report of Scottish Water’s performance, we published a letter highlighting our concerns about the quality and completeness of Scottish Water’s reporting. We highlighted slower than expected progress in providing appropriate visibility of future investment needs and progressing work on asset replacement. Scottish Water has committed to improving its progress across these areas and we will continue to monitor this carefully.

We are increasingly focused on making sure that the information we collect from Scottish Water, and its reporting to us and other stakeholders remains fit for purpose. This year, we have made some important changes and clarifications to the information we ask of Scottish Water. In addition to requiring a significant improvement in the quality of reporting included in Scottish Water’s annual return, we further defined our expectations around how Scottish Water reports the revenue and costs of its core business and its reporting of potential future investment needs.

International leadership

Our third strategic objective is to become international leaders in the field of economic regulation, as part of our commitment to supporting the Scottish Government’s Hydro Nation initiative. Our involvement helps ensure that we stay at the forefront of regulatory best practice while sharing our own expertise in water sector regulation with other countries. Our input brings a direct financial benefit by reducing the levy that we would charge Scottish Water. Furthermore, these

international opportunities provide valuable learning experiences for our staff, thereby supporting our employee recruitment and retention.

During the year we have continued our work with the New Zealand Government’s Department of Internal Affairs (DIA) as they prepare for the introduction of economic regulation and water reform. We participated in a small project to support New Zealand’s Ministry of Transport which involved examining regulatory models and their application to New Zealand’s state highway network.

Other projects included supporting the Romanian regulator (ANRSC) as part of a consortium with the consultancy BDO and working with Romanian operator Apa Vital to develop its business plans and supporting regulatory information.

More widely we have continued to build our relationships with other overseas regulators, including through presenting at international conferences and by working with international organisations.

Internal operations

In relation to our working arrangements, like many other organisations we have been considering options for our future as we emerge from the pandemic. This year we trialled a hybrid arrangement, based on part home working and the use of flexible office and meeting space. Our employees have continued to work effectively from home but have benefitted from meeting regularly with colleagues and stakeholders in central locations.

This year we held our first in-person assessment centre since before the pandemic and welcomed two new analytical staff to the team. We have continued to develop and improve our recruitment approach which now benefits from efficient online tools and face-to-face interactions with candidates.

We are pleased to have made progress this year in relation to our equality and diversity commitments. We have focused on offering mental health first aid training to all employees and now have 3 mental health first aiders in the organisation.

2022-23 has been a busy and challenging year. The office has risen well to the challenges. I would like to thank each and every member of the team for their continuing commitment to our work in driving improvements for Scotland’s water and sewerage customers. The office is well placed for the remainder of this regulatory control period.

Our purpose and strategy

We are a non-departmental public body with a statutory duty to promote the interests of Scottish Water’s customers. We do this by challenging Scottish Water to achieve long-term value and best- in-class levels of service for its customers and communities.

We published our Corporate Plan for the period 2021-27 in December 2020. The plan, which was agreed with Scottish Ministers, explains:

- our strategic objectives

- the outcomes we are setting out to achieve for customers, communities and other stakeholders

- the activities we will need to undertake to deliver these outcomes

- the resources necessary.

Our Corporate Plan is focused on ensuring that we continue to meet our statutory obligations to current and future customers. It will ensure that we contribute fully to the delivery of the water sector vision. This is particularly important given the need for Scottish Water to achieve net zero emissions by 2040 (on both an operational and an embodied basis) and to maintain service levels by repairing, refurbishing and replacing the industry’s assets in a timely way. Climate change will often mean that there is too much water where we do not want it and too little in the places that we do. Scottish Water will have a crucial role in managing how we adapt to our changing climate.

We report our progress against the objectives set out in the Corporate Plan each year in our annual report.

Our organisational model

We have 25 employees and are sponsored by the Scottish Government’s Directorate for

Environment, Climate Change and Land Reform.

Our Board comprises four non-executive members (including the Chair) and the Chief Executive Officer (CEO). The Board is responsible for overall governance. Further information about our Board Members and about the role of our Audit and Risk Committee (ARC) is covered in the governance statement within the Accountability Report.

We are funded through a levy on Scottish Water and on the retailers that participate in the competitive non-household market. The size of these levies is set by Scottish Ministers in light of the objectives and key targets agreed through the corporate planning process. Where resources allow, we seek to supplement that income with income derived from the external projects that we undertake as part of our international work.

Our operating environment

We work closely with many stakeholders, and these relationships are summarised below.

Stakeholder |

Interaction with our work |

| Scottish Parliament | We are accountable to the Scottish Parliament through Scottish Ministers |

| Scottish Government | The Scottish Government sets the overall objectives and principles of charging for the water industry in Scotland |

| Scottish Water |

We have a duty to protect the interests of both current and future customers by making sure that:

|

| Scottish Environment Protection Agency (SEPA) | SEPA regulates Scottish Water's performance regarding compliance with environmental standards and investment in improvements |

| Drinking Water Quality Regulator (DWQR) | The DWQR regulates Scottish Water's compliance with drinking water quality and investment to protect public health |

| Consumer Scotland | Consumer Scotland is the statutory, independent voice for consumers in Scotland. Its Board commenced their responsibilities in April 2022 and will take on the water consumer functions previously delivered by Citizens Advice Scotland |

| Central Market Agency (CMA) | The CMA administers the competitive non-household retail market. It is a separate organisation from the Competition and Markets Authority, a UK body, that ensures markets deliver appropriately for consumers |

| Scottish Public Services Ombudsman (SPSO) | With responsibility for complaints and dispute resolution in the water sector, the SPSO provides insights into levels of trust and confidence among consumers |

Our key activities and priorities

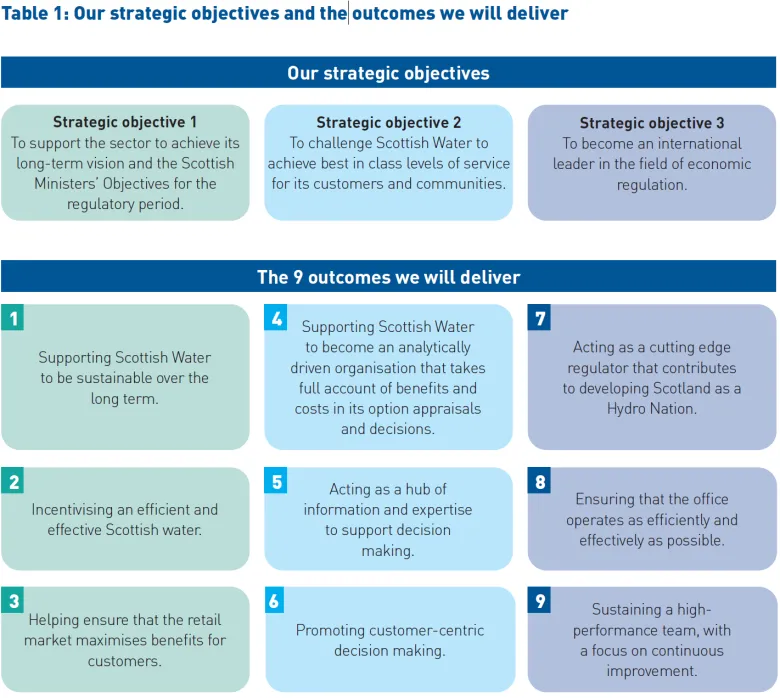

The three strategic objectives that were identified in our Corporate Plan 2021 are each underpinned by three outcomes. The objectives and outcomes are set out below. Each year we prepare an annual work plan which sets out the areas of focus and specific activities we will undertake during the year, to help us deliver our objectives.

Our key challenges and risks

The strategic risks the organisation faces were determined as part of the corporate planning process for the regulatory period.

Our principal strategic risk is around our failure to deliver our statutory duties. This would severely damage our credibility within the sector and impact our ability to regulate.

We strive to limit any exposure to a loss of reputation and aim to be respected across the industry both nationally and internationally. Our reputation provides a robust platform that is critical to our ability to engage in dialogue with diverse stakeholders and to further our Hydro Nation activities.

This risk is actively managed by adhering to public body governance best practice, including Board oversight of governance policies, independent internal and external audit, and organisation reporting requirements.

During the year, we have continued to manage our risks which are reviewed by our Board and Audit and Risk Committee and are discussed on a regular basis by an operational board.

Underpinning the principal risk are three strategic risks which focus on:

- Ensuring we are resourced appropriately and that succession plans are in place.

- Staying attuned to the external landscape of the water industry and the strategies of our stakeholders in order to respond to changes.

- Remaining compliant with all relevant laws, regulations and policies and demonstrating the standards expected of a non-departmental public body in Scotland.

The steps we have taken this year towards minimising the risks include further training and developing our leaders to ensure we have a capable team to take the organisation into the future. We will embark upon a review of roles and priorities for all employees and build upon our training and development programmes to ensure our staff have the skills required to support the needs of the organisation.

By engaging regularly with stakeholders and undertaking horizon-scanning activities we stay abreast of external developments impacting the sector.

We ensure compliance with legislation and policies by having policies and procedures for our operational functions in place, of a standard expected of a non-departmental public body. We ensure that our governance processes are up to date, in line with Scottish Government’s good practice, by retaining legal support and a strong relationship with our Sponsor Team.

Finally, our Audit and Risk Committee oversees the production and ongoing review of our compliance report and associated actions.

More information on our key risks and the impact these have on delivering our outcomes can be found in the risk section of the performance analysis.

Performance analysis

Performance against key outcomes

The progress we have made against the nine outcomes is summarised below.

Outcome 1: Supporting Scottish Water to become sustainable over the long term

This year our focus has been on developing our approach for the next Strategic Review of Charges. We have been working with economics consultancy Oxera to develop the key areas of focus for our methodology and discussing these options with our Board.

Our methodology will take account of Scottish Water’s progress on its transformation journey and aim to ensure that the industry continues towards a more sustainable future. We have been considering with stakeholders, the most appropriate timeline for the next price review in light of the change in revenue profile away from that set out in the 2021-27 final determination.

During the year Scottish Water begun work to develop a long-term strategy and investment baseline for the remainder of the regulatory control period. Scottish Water’s August information submission to us represents a first step in understanding how it will manage costs and revenues to deliver the required investment. However, significant further work is required to inform discussions among industry stakeholders about what can be achieved within the financial envelope that is available.

Outcome 2: Incentivising an efficient and effective Scottish Water

We are continuing to work with Scottish Water on the development of its reporting mechanisms for the 2021-27 regulatory control period and beyond. This includes the information request noted above and the annual return to ensure that regulatory reporting remains fit for purpose.

This year, we made specific changes to the regulatory framework. We have requested additional information from Scottish Water on the revenue and costs of its core business and its reporting of potential future investment needs. A key feature of the regulatory information framework is now establishing a robust investment baseline for the remainder of the regulatory control period and developing a full picture of potential future investment needs.

We published our report of Scottish Water’s 2021-22 performance in March 2023. This covered the first year of the new regulatory control period and concluded that Scottish Water broadly maintained its performance. The report does show some slippage in the delivery of Scottish

Water’s investment programme which is evident when comparing reported expenditure to that allowed for in the final determination. Together with other stakeholders, we have requested

increased visibility of the investment programme in Scottish Water’s reporting of both current and future investment requirements.

Scottish Water’s progress in these areas will be critical and inform our overall approach and

methodology for the next price review.

Outcome 3: Helping to ensure the retail market maximises benefits for customers

Following the pandemic, we initiated a process to review the financial resilience of retailers to protect the integrity of the market and make sure that it is sufficiently resilient to any future shocks. The failure of energy retailers demonstrated subsequently how important ensuring the financial resilience of market participants can be. During the year we concluded this important work with all active retailers now signed up to an additional licence condition. Scottish Water has now issued its methodology for how it will assess the financial strength of retailers moving forward.

We have taken further steps to introduce a ‘market health check’ process. Once established, this process will allow retailers to demonstrate they are operating in line with the principles of Ethical Business Practice. During the year, the industry stakeholder group appointed an interim Market Health Checker who proposed a practical set of options for the implementation of the process.

Future work will develop a code of practice and a full methodology for the market health check.

During the reporting year, Scottish Water has embarked upon a strategic review of Business Stream and its governance arrangements. We are continuing to engage with Scottish Water and Business Stream on the future governance structure and the implications for the Governance Code. Further work will be required during the remainder of 2023.

Outcome 4: Supporting Scottish Water to become an analytically driven organisation that takes full account of benefit and costs in its option appraisals and decisions

In SRC21-27 we adapted the regulatory framework to move away from a fixed six-year investment programme. This change allows greater flexibility for Scottish Water to plan and prioritise its investment programme in a more dynamic way, thereby ensuring maximum long-term value. A key driver for this change in approach was to enable Scottish Water to address the investment challenges of climate change and asset replacement.

During the year we have continued to encourage the work of Professor Dr Bryan Adey of ETH Zurich as he assists Scottish Water in developing its Asset Management Transformation Plan (AMTR). We welcome the initial work that Scottish Water has embarked on to develop the capacity and capability to better manage its infrastructure on behalf of customers. However, we are concerned with the relatively slow progress in this area given the significance of the asset replacement challenge the organisation faces.

We expect Scottish Water to set out in a consistent and transparent way, what choices are being made, the implications of these choices and the evidence to support these decisions.

This year, we began further work to understand the sustainable level of long-term asset replacement, repair and refurbishment investment across different countries (Australia, England, New Zealand and Scotland). This analysis which included Northumbrian Water, Scottish Water, Sydney Water and Watercare in New Zealand ensured that the interactions and potential overlap of future enhancement, growth and asset replacement investment were being recognised and considered. The output of this work will contribute to Scottish Water’s future reporting of asset replacement requirements and our thinking on asset replacement for the next Strategic Review of Charges.

Outcome 5: Acting as a hub of information and expertise to support decision making

An important element of our commenting on Scottish Water’s performance is for us to have a wide and detailed understanding of regulatory frameworks and approaches in other countries and jurisdictions. This enables us to identify areas of best practice or innovation in asset-intensive industries, which we can then draw on in our work with Scottish Water.

This year we have continued to share knowledge and expertise with other regulatory organisations and regulated companies at home and abroad. This activity helps us to remain at the forefront of regulatory best practice and achieve better outcomes for customers and the environment in the water sector in Scotland. We have continued to build our relationships with a wide network of leading practitioners, academics and policy makers. We have attended workshops, discussion forums and other events sharing our experience with others.

Our CEO delivered training for a programme developed by InterAmerican Development Bank, the Lisbon International Centre for Water (LIS-Water) and the Association of water and sanitation regulators of Americas. The programme included more than 200 participants from regulators and policy makers from over 20 countries in Latin America and the Caribbean.

Outcome 6: Promoting customer-centric decision making

In the final determination we welcomed Scottish Water’s commitment to carry out a ‘world leading’ national engagement programme with customer and communities. It is important that Scottish Water considers the kind of water industry that customers and society want and the impact of these options on future investment levels and performance over time.

Further work is required from Scottish Water to evidence that customers and communities’ views have been considered in their assessment and prioritisation of current and future investment. We will consider Scottish Water’s progress in determining our approach for the next strategic review of charges.

Outcome 7: Acting as a cutting-edge regulator that contributes to developing Scotland as a Hydro Nation

We support the Scottish Government’s Hydro Nation initiative by building partnerships with others and sharing our regulatory expertise. This year, we have continued to support the DIA in New Zealand in preparing for the introduction of economic regulation and water sector reform. This involved providing advice and analysis to the DIA and Ministers on important considerations for water reform based on our experience in Scotland including the need for a properly managed transition.

Our international work provides useful opportunities for our employees to build knowledge and skills in interesting new areas and to train others in regulation – in turn contributing to their own development and progression. Our analysts benefitted from spending time living and working in Auckland to support Watercare to prepare its business plan and associated regulatory information tables.

We have participated in a series of workshops and events to strengthen our network of international project partners. This year, our CEO and Director visited Romania to build on existing relationships and explore future project opportunities. We met with BDO, Ministry Departments, ANRSC, European Bank for Reconstruction and Development (EBRD), European Investment Bank (EIB) and travelled to the three regional operating companies we worked with during our previous European Commission Structural Reform Support project – Suceava, Iasi and Cluj. As part of this, we hosted a one-day training workshop for Romanian colleagues in Edinburgh.

More widely we have continued to extend our links with other overseas regulators and organisations such as the European Water Regulators (WAREG), the Organisation for Economic Cooperation and Development’s (OECD) Network of Economic Regulators, and development banks such as the EBRD. We continue to seek new opportunities for business development by building partnerships with international stakeholders and exploring links with potential contractors. This helps ensure that we can contribute to the Scottish Government’s Hydro Nation strategy.

Outcome 8: Ensuring that the office operates as efficiently and effectively as possible

As a public body we are very conscious of our obligations to deliver value for money. This year, we have taken further steps to review the way we deliver our objectives to ensure our spending is as efficient as possible. We have begun work to review our operations, structure and roles to demonstrate we are operating as effectively as possible. We are working with the Scottish Government and others in the public sector to review the scope for further synergies including making use of shared services and increasing revenue generating activity through our international work.

We are continuing to benefit significantly from the reduced costs associated with moving to more flexible working arrangements. Our employees have been operating very effectively in a hybrid remote model which has removed the need for a large permanent office space.

During the year we have taken further steps to ensure appropriate technical security controls are in place to strengthen our defences in line with the Scottish Government’s cyber resilience framework and Cyber Essentials Plus standards. This work has included continually training our employees, reviewing our business continuity arrangements, and appointing a cyber incident response specialist.

Outcome 9: Sustaining a high-performance team, with a focus on continuous improvement

In line with our graduate recruitment strategy, we are continuing our efforts to recruit a diverse range of individuals for our analytical team. To support our efforts, we are pleased to have been granted a visa sponsorship licence which will allow us to employ a wider pool of candidates with a range of nationalities.

This year we recruited two successful analytical graduates to our team and welcomed a summer intern who joined us as part of the Economic Futures programme. To further raise the profile of WICS as a graduate employer, we have increased our engagement with universities and plan to run a series of seminars on economic regulation for students across Scotland.

Our international work in New Zealand has provided an excellent learning opportunity for our employees with a number of staff having spent some time living and working abroad this year. We are committed to training and developing our employees. A key focus of training during the year related to cyber security and awareness.

Key performance indicators

Our Corporate Plan identified 11 key performance indicators (KPIs) against which we are measuring the success of delivering our nine outcomes over the regulatory control period. We identified the key KPIs for this financial year and our performance against each is described in detail in this section.

The KPIs that were identified for this financial year are outlined in the table below, with an analysis of how we performed against those indicators.

| Outcome | KPI | Performance during 2022-23 |

| 1-3 | We will implement a regulatory framework that enables and supports Scottish Water to take full ownership of its relationship with customers and its decision making. We will report annually to the Board, and in our statutory annual report and accounts, on progress. |

We have worked with Scottish Water as it begins to transform its business to support the new regulatory framework. We have reiterated our requirements and expectations in a series of regulatory letters to Scottish Water. |

| 1-3 | By December of each year we will publish our annual reports on Scottish Water’s overall performance in delivering the requirements set out in the 2021-27 final determination and identify any gaps that have the potential to impact on the level of trust among its stakeholders. | Our assessment of Scottish Water’s 2021-22 performance was published in March 2023. The delay to the publication was largely a result of Scottish Water’s request to extend the annual return process. |

| 4-6 | Our annual reports on Scottish Water’s overall performance will include an assessment of its progress in ensuring that project appraisals encompass a full assessment of the economic costs and benefits of investment. This assessment should include aspects such as the carbon impact, and of natural and social capital. | We have published our report of Scottish Water’s 2021-22 performance. Alongside this report, we published a letter highlighting that further work is required to support the planning and prioritisation of investment. |

| 4-6 | Our annual reports on Scottish Water’s overall performance will include an assessment of its progress in ensuring that customers and communities are involved in decision making. This will encompass assessing the extent to which customers could reasonably have confidence that their views are being heard and acted upon. | Whilst the 2021-22 performance report focused on information and reporting, we have reiterated that Scottish Water has committed to deliver the requirements set out in the Strategic Review of Charges 2021-27, including in relation to holding a ‘national conversation’. |

| 7 | We will report annually on request for regulatory advice and information and expertise from industry stakeholders and international partners, and on the nature of support we have provided. | We have responded to requests from international partners to provide advice and information this year. The contributions we have made are summarised in this report. |

| 7 | We will support the Scottish Government’s Hydro Nation initiative by delivering projects and assistance, providing a minimum annual net contribution to our income from this work of £300,000. |

We delivered ongoing projects with the DIA and the New Zealand Ministry of Transport. We received a net contribution to income from these activities, excluding remuneration costs and overheads, of £817k. |

| 8 | Each year of the Corporate Plan period, we will set out in an annual workplan the activities which we will undertake during the year. In the following year our Annual Report will include information on progress against our workplan. | Our 2022-23 work plan was approved by the Board in April 2022. Regular updates against the work plan are provided to the Board at each board meeting. These updates have informed the summary of performance in this annual report. |

| 8 | We will ensure that our income and costs remain within budget targets over the regulatory control period and will report our financial performance on a regular basis to the Board. | We delivered our priorities in 2022-23 in line with the corporate plan and budget. For more information on the financial results for the year, see the section on financial performance. |

| 9 | We will achieve the desired structure for the office by 2025 and ensure that progress remains on track in the interim. | Recruitment efforts this year have resulted in two further analytical appointments. The focus during 2023- 24 is to review our operations, structure and roles to demonstrate we are operating as effectively as possible. |

Key risks

Underpinning the principal risk of the overall failure of our statutory duties are three strategic risks. Operational risks are managed at a business area level, and these operational risks are linked to the three strategic risks.

Strategic risk 1

If we do not properly plan for the succession of key roles or adequately manage our resources and the retention of staff, then the organisation might lose focus and direction, causing significant business interruption.

As a small office, we need to make sure that we are able to attract and retain the best talent, ensure succession of senior roles, and that all employees have the skills, training and expertise they need. We will focus on ensuring that we have the resources, skills and experience in place to deliver the overall strategy and objectives now and in future.

Last year, we completed a succession planning exercise for our senior leadership team. We are continuing to support our leaders through individual and team coaching to ensure they have the skills to support the needs of the organisation now and into the future. We have begun work to review the roles and priority areas for each member of staff including a review of the development path for our analysts.

Strategic risk 2

If we are not attuned to the external landscape and the strategies of our stakeholders, there is a risk that we are unable to respond adequately to political, legislative or stakeholder driven changes within the industry.

Throughout the year we have maintained regular stakeholder liaison, including through our participation in a range of industry forums such as the Stakeholder Advisory Group (SAG), the Delivery Assurance Group (DAG) and the Investment Planning and Prioritisation Group (IPPG) and retail market forums.

We have worked closely with Scottish Water and the Scottish Government to progress the 2021- 27 regulatory control period and options for the next strategic review, to further achievement of the industry vision.

We maintain contact with leading thinkers within the sector to ensure an innovative approach is maintained. This is developed through regular external engagement sessions with leading edge practitioners, academics and policy makers. Our Hydro Nation and horizon scanning activities provide a useful source of engagement, external benchmarking and assurance.

Strategic risk 3

If we are unable to act appropriately and proportionately within the expectations of public bodies as set out, from time to time, by the Scottish Government, in compliance with all relevant laws, regulations and policies then there is a risk that our activities are significantly disrupted, and reputation undermined.

We adopt the appropriate standards of corporate governance and put in place measures to ensure compliance. The policies and procedures of all operational functions of the organisation will be driven by applicable laws and regulations and the standards expected of a non-departmental public body.

Our governance processes are up to date, in line with Scottish Government’s good practice and reviewed regularly internally and by internal audit. During the year, we reviewed our business continuity arrangements and updated our business continuity plan. The Cyber and Fraud Centre - Scotland reviewed our updated plan and provided assurance that our arrangements are in line with industry best practice.

Financial performance

We prepare a detailed annual budget, in line with our Corporate Plan, which is submitted to our Board for approval. We use a comprehensive budgeting and financial reporting system, which aligns with the Scottish Public Finance Manual (SPFM), to compare actual results to the budgets that our Board has approved. Management accounts are prepared each month, with significant variances from budget investigated and reported. Cash flow and other financial forecasts are prepared regularly throughout the year to ensure that we have sufficient cash to meet our operational needs.

Financial performance 2022-23

As set out in the financial statements, there was a net surplus for the year of £1,264,866 (2021-22:

£610,268) before any adjustments for actuarial gains or losses. The use of surplus funds is outlined in our corporate plan for the period 2021-27.

Total income received for the year was £5,287,598 (2021-22: £4,480,585). Income received from Scottish Water and the licensed providers was in line with the corporate plan.

We received income of £1,185,029 (2021-22: £479,455) in relation to our work delivering projects in support of the Scottish Government’s Hydro Nation initiative. The majority of this was received from the DIA in New Zealand, being a continuation of earlier work we carried out in support of water reform in the country.

We also received £105,551 (2021-22: £71,966) in relation to rent and service charge costs relating to the sub-lease of the corporate office.

Expenditure for the financial year 2022-23 was £4,036,890 (2021-22: £3,870,560). The main reason for this increase in expenditure of £166k (4%) was the additional travel, and associated costs, required for the project in New Zealand. This expenditure was reimbursed by the DIA and is included in the increased income.

The internal budget agreed at the start of the financial year by the Board was a net income position of £404,204. International projects resulted in additional net income of £447,813 compared to budgeted expectations. Excluding the IAS 19 adjustment to remuneration costs1, remuneration costs were over £200k lower than the budget. These savings were the result of three employees leaving during the year who were not replaced. Further savings were made against the budget in travel and expenses. As the majority of the travel during the year related to the project in New Zealand, the cost of which was reimbursed by the DIA, less travel costs were required for other activities.

The Reserve balance as at 31 March 2023 was an asset of £3,592,251 (2021-22: liability of

£149,407). The main contributors to the improvement of this position are:

- The movement of the net pension liability from a liability of £2,201,000 at the end of 2021- 22, to a liability of £34,000. The actuarial valuation of our pension obligations, at 31 March 2023, has decreased by £4.5m (33%). This change was driven by the assumption of the discount rate used to value the pension obligations. The corporate bond yield (upon which the discount rate is derived) has risen over the period which has led to an increase in discount rate from 2.75% to 4.75%. However, to comply with IFRIC 14 and IAS 19 the pension asset is restricted to reflect the amount the employer is entitled to as an unconditional refund of the surplus or reduction in future contributions to the pension fund. Actuarial advice was sought in relation to the benefit to us in the form of reduced future contributions. IAS 19 defined this to be the present value of future service costs, less the present value of projected future contributions (in respect of benefit accrual). As this was a negative figure, the net pension asset was restricted to zero. However, unfunded pension benefits of £34,000 are included as a liability at the end of the year.

- As a result of the work carried out in New Zealand, our cash balance has increased by over

£1m and the year-end debtor balance by £473k, comprised of amounts due (and paid soon after the financial year-end) from the DIA.

Supplier payment policy

It is our policy to pay all supplier invoices that are not in dispute within the terms of the relevant contract and as soon as possible following receipt of an invoice. In line with the Scottish Government’s guidance, we aspire to a 10-working day target for paying bills to businesses in Scotland. Paying supplier bills promptly is seen as a key objective, and an important expression of our commitment to supporting business. The average time taken to pay suppliers in 2022-23 was 4 days (2021-22: 7 days).

The Public Services Reform (Scotland) Act 2010

The Public Services Reform (Scotland) Act 2010 imposed duties on the Scottish Government and on public bodies such as WICS to publish specific information about their expenditure. The Act requires us to publish two statements outlining the steps we have taken to promote and increase sustainable growth and to improve efficiency, effectiveness and economy. The duties to publish this information are intended to promote greater openness and transparency. We publish a report on our website setting out our response to the requirements of the Act.

Social matters

Our statutory purpose is designed to deliver environmental, social and economic success. We take our social responsibility seriously and ensure that all staff policies and procedures are up to date and comply with the most recent legislation.

Anti-bribery and corruption

As part of our zero-tolerance approach towards fraud, bribery and corruption we have an employee code of conduct, whistleblowing policy and clear policies regarding acceptable levels of gifts and hospitality (both given and received). We actively encourage staff to be aware of appropriate behaviours with both customers and suppliers. We maintain a gifts and hospitality register.

No frauds were detected in 2022-23.

We take malpractice very seriously and are committed to conducting our business with honesty and integrity. We encourage open communication from all those who work for us, and we want everyone to feel secure about raising concerns. Our internal whistleblowing policy is in place to encourage and enable employees to raise concerns on a confidential basis. All staff are protected under whistleblowing laws if they raise concerns in the correct way.

We have an external whistleblowing policy which aims to assist contractors and the general public should they need to raise concerns about the water industry in Scotland.

We did not receive any whistleblowing cases during this reporting period.

Transparency of information

We aim to be open in all that we do; our default approach is to publish information on our activities on our website whenever possible. We maintain frequent dialogue with industry stakeholders and regularly set out our approach and decisions in published papers.

Complaints

We value and recognise the learning that complaints can generate, and we use complaints information to help us improve the services we provide. During the year we did not receive any complaints (2021-22: nil).

Our sustainability performance

Scotland has some of the most ambitious greenhouse gas reduction targets in the world and we wish to contribute as much as we can to help deliver this world-leading climate change action.

Public Bodies in Scotland are bound by the Climate Change Public Bodies Duties as set out in Part 4 of the Climate Change (Scotland) Act 2009. These duties require public bodies, in exercising their functions to:

- contribute to carbon emissions reduction (climate change mitigation);

- contribute to climate change adaption; and

- act sustainably.

As a small office, we recognise that the extent to which we can continually reduce our carbon footprint is limited. That said, we do all that we can to make sure that our internal office functions are delivered in a sustainable and carbon aware manner. Our internal policies encourage employees to make carbon aware decisions in relation to procurement and travel.

Working from home has provided an opportunity to carry out our functions remotely, without the need to commute daily. We are continuing to sublease our office space from 1 July 2021 to 30 September 2024 with the option to extend this until March 2026.

Following the Covid-19 pandemic we resumed international travel in February 2022. However, our experience of remote working has allowed us to carry out much of our work for international partners from home. Overseas travel is sometimes required to support our international projects and some of our employees spent time working abroad in New Zealand during the year. We off-set our carbon footprint from international travel by funding tree planting in Scotland.

Details of our carbon footprint is provided in the following table.

| 2022-23 | 2021-22 | |||

| Area | Non-financial information | Financial information | Non-financial information | Financial information |

| Energy |

Electricity: N/A Gas: N/A Total carbon from energy: N/A |

Electricity: - Gas: - |

Electricity: 0.3 tonnes CO2 Gas: 0.2 tonnes, CO2 Total carbon from energy: 0.5 tonnes CO2 |

Electricity: £195 Gas: £374 |

| Waste |

Waste to landfill: negligible Total carbon from waste: negligible |

- |

Waste to landfill: negligible Total carbon from waste: negligible |

£203 |

| Water | N/A | - | 0.01 tonnes CO2 | £344 |

| Transport and travel | 14.2 tonnes CO2 | £244,686 | 5.2 tonnes CO2 | £9,826 |

The information in this table is based on our best estimates. We used the following sources for the information:

- Energy: all information based on actual usage as reported on gas and electricity invoices. Waste: financial information taken from actual invoices received in relation to waste collection and shredding services.

- Water: information based on water consumption reports detailing water, sewage and drainage volume and financial charges.

- Transport and travel: Financial and mileage volume relating to vehicles is based on mileage estimates of journeys taken by employees during the year and estimated expenditure.

All conversions to carbon consumption are calculated using data available from the Department for Environment, Food and Rural Affairs.

Alan D A Sutherland, Chief Executive Officer

December 2023