1.1 Statement from the Chair

I am pleased to present WICS’ Annual Report for 2024-25, marking the fourth year of our current regulatory control period. This report highlights the progress we have made in strengthening our organisation, enhancing our regulatory framework, and delivering on our core responsibilities.

These developments demonstrate our essential role in protecting customers’ interests and ensuring that water services in Scotland are delivered efficiently and at the lowest reasonable cost.

Reflecting on our achievements

This year, we published our methodology for the Strategic Review of Charges (SRC27), which will determine investment levels and customer charges for water and sewerage services from 2027 to 2033. Our approach is clear and focused on delivering long-term value for customers. Enhanced outcome measures will ensure that priorities such as service quality, affordability, and environmental performance are monitored effectively throughout the 2027–33 period.

Our approach places customers at the heart of the process. This year, we also agreed a Memorandum of Understanding with Scottish Water and Consumer Scotland, formalising the role of customers in shaping regulatory decisions and ensuring their voices are central to matters that affect them.

We have strengthened the non-household retail market by working with Consumer Scotland and Scottish Water to develop a new Code of Practice. This gives businesses, charities, and public bodies stronger protections and greater confidence in the services they receive.

Together, these achievements demonstrate our commitment to acting in the public interest and delivering outcomes that matter most to customers.

Challenges and opportunities

This year has seen a significant organisational transformation at WICS. In response to the Auditor General’s Section 22 report on WICS’ 2022–23 Annual Report and Accounts, we have worked hard to strengthen our financial control, governance and management. These reforms have made WICS a more effective and efficient organisation committed to delivering value for money and maintaining public confidence in our work.

We transformed our leadership team, creating a smaller, more accountable senior structure. This has delivered significant savings and has allowed us to increase capacity across the organisation.

Shared services have further improved operational efficiency, including the use of Scottish Government procurement frameworks for interim professional services, IT, and other support functions. Key work, including the SRC27 methodology, has been brought in-house, building internal capability and reducing professional services costs. A review of IT contracts and infrastructure has substantially reduced costs while maintaining service levels and cyber resilience.

We also reviewed the Board's effectiveness to ensure that members are supported in providing robust challenges and oversight. This has been strengthened by the introduction of a revised governance framework and scheme of delegation. Combined with proactive engagement with the Scottish Government’s independent review, the Public Audit Committee (PAC), and parliamentary scrutiny, these reforms have reinforced transparency, accountability, and our commitment to learning from the past while preparing for the future.

The importance of our role

Scotland has benefited from a model where Scottish Water is publicly owned, commercially operated, and subject to robust economic regulation. As an independent economic regulator, we play a key role in ensuring that Scottish Water delivers value for money for the people of Scotland. By monitoring and reporting on costs and performance, setting clear expectations, and holding the company to account, we ensure that Scottish Water operates efficiently, sustainably, and always in the interests of Scottish customers.

Looking ahead

As we review Scottish Water’s business plan and deliver our determinations for 2027–33, our priority is to ensure customer interests remain at the centre of decision-making. We will continue to engage closely with stakeholders to ensure Scotland’s water industry is equipped to meet current and future challenges.

Wider developments in the sector, including the Independent Water Commission’s review in England and Wales, provide opportunities to learn and improve our approach in Scotland. We, alongside our industry colleagues, will consider lessons from these findings to strengthen our regulatory model.

We are committed to a regulatory approach that drives efficiency and innovation, ensuring the long-term sustainability of Scotland’s water industry. At its heart, our work is focused on delivering tangible benefits to customers—ensuring that services remain resilient, high-quality, and offer the best value to the Scottish public for years to come.

In conclusion, I would like to take this opportunity to thank our employees for their dedication, support, and professionalism throughout the year. Their commitment has been fundamental to WICS’ improvement programme and continuing success in meeting our regulatory responsibilities.

Ronnie Hinds

Interim Chair

November 2025

1.2 Performance statement from the CEO and Accountable Officer

As Scotland’s economic regulator for water, WICS exists to ensure customers receive genuine value from their water and wastewater services. In 2024–25, we not only held firm to that core role but also reset the organisation to strengthen governance, restore accountability, and prepare for the long term.

During this period, I served as Interim CEO and Accountable Officer before being confirmed as permanent CEO in June 2025. I am proud of how the team has responded. Together, we have delivered for customers through our regulatory work, while laying the foundations that will support WICS for years to come.

Strengthening WICS

Our reforms have been driven by a single guiding principle: to reinstate the Commission with the purpose and intent set out by Parliament when WICS was established in 2005. The alignment between the spirit of the legislation and the way WICS operated was not as sharp as it should have been. This year, we have brought that alignment back into focus. Governance now sits firmly with a strengthened Commission, supported by a clear and accountable Executive.

We acted on the Scottish Government’s independent review, the Auditor General’s Section 22 report, and the PAC’s findings. Together with the Scottish Government, we agreed and implemented a 21-point action plan, alongside a wider 55-point change programme to strengthen oversight, tighten controls, and embed transparency.

A key element of this work was restructuring the leadership team. We confirmed four new directorates and reduced the size of the leadership team. Each role is now clear: the Commission sets direction, provides challenge and holds to account; the CEO leads execution; and the Executive delivers. This is a significant step forward. It restores clarity, strengthens governance, and embeds accountability. It also creates space for succession planning and future leadership, ensuring WICS is not reliant on any one individual, but resilient by design. Key changes included:

- A revised governance framework and new interim Board appointments.

- Stronger audit and risk arrangements.

- New appraisal, recruitment and training policies.

- Clearer decision-making and a reset relationship with the Sponsorship Team.

WICS is now on a sounder footing, better able to deliver its core role and to meet the standards expected of a public body.

Delivering value for customers

In 2024–25, we revised our annual work plan to focus our resources where they add the most significant value. The three strategic objectives in our 2021–27 Corporate Plan have guided this work, and over the past year, we sharpened our focus on them at a critical time for the organisation. We remained firmly focused on ensuring that customers receive the best possible value for their water and sewerage services.

Supporting the sector vision and Ministerial objectives

This remained our priority. We have published the methodology for the Strategic Review of Charges 2027–33, setting out a clear framework that enables Scottish Water to deliver the Minister’s objectives and prepare for the future. A central feature of this methodology is the involvement of customers. We finalised new arrangements to ensure customers’ views and stakeholder perspectives directly shape the review process and its outcomes.

Challenging Scottish Water to achieve high-quality service levels

We strengthened our oversight and refined the data we collect from Scottish Water. This work is critical for setting price limits and monitoring performance. We published detailed business plan guidance and comprehensive data tables, providing a rigorous baseline against which Scottish Water’s future performance can be assessed. This marks a step change in the quality and depth of regulatory information.

Refocusing our international engagement

In the past, we shared our expertise widely overseas. This year, at a critical moment for WICS, we made the deliberate choice to pause international consulting and concentrate resources domestically. This focus allows us to demonstrate excellence where it matters most: in regulating Scottish Water. At the same time, we continue to engage actively in international regulatory debates — through the OECD’s Network of Economic Regulators and by contributing a Scottish perspective to the Independent Water Commission’s call for evidence as part of Sir John Cunliffe’s review of the water industry in England and Wales.

Across these key areas, we have demonstrated real discipline in how we work, ensuring value is delivered where it matters most to customers in Scotland. This same principle will guide us as we begin to shape our next Corporate Plan for 2027–33.

A personal commitment

I want to thank every member of the WICS team. Over the past year, we have delivered significant change while operating below full capacity. That requires resilience, commitment, and a strong belief in our mission.

As CEO, my personal commitment is clear: to rebuild trust in WICS, to keep transparency and accountability at the heart of everything we do, and to create an organisation where people are proud to work.

We are not yet at full strength, but we are building momentum. By 2026–27, we will be at full complement. With the right people in place, the right structures around them, and a culture of continuous improvement, WICS will be stronger, more resilient, and better positioned to deliver lasting value to customers and Scotland’s water sector.

1.3 Performance overview

This performance overview summarises our purpose, the outcomes we aim to achieve, and the key challenges and risks we face.

OUR PURPOSE

As the economic regulator, we ensure that the water industry delivers for the people of Scotland. We regulate Scottish Water to provide high-quality, efficient, and sustainable water and wastewater services for today’s customers and future generations. We hold Scottish Water accountable for its performance and ensure it delivers the best possible value for customers. Through the Strategic Review of Charges, we help the industry plan for the future and set a cap on charges, ensuring customers pay no more than necessary for essential services now and in the years ahead.

WHY WATER MATTERS

Water is essential for life, society, and the economy. We rely on Scottish Water to:

- Deliver clean, high-quality drinking water at the turn of a tap

- Collect, treat, and return wastewater and surface water safely

- Protect our natural environment; and

- Provide these services affordably and sustainably

Scotland benefits from a model where Scottish Water is publicly owned, commercially run, and independently regulated. This approach has enabled:

- Lower water charges – average household bills for 2024–25 are £125 lower than they would have been without regulatory efficiencies, remaining among the lowest in the UK.

- High investment levels – Scottish Water has invested the most per person in the UK water industry since 2002.

- High customer satisfaction – Scottish Water is among the top-ranking companies in Scotland in terms of customer service, as measured by the UK Customer Satisfaction Index (UKCSI), and it outperforms the average UKCSI for the water sector across the UK.

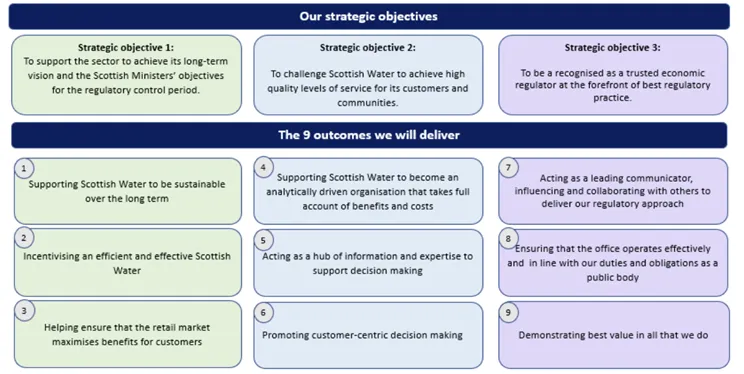

OUR STRATEGY

WICS is a non-departmental public body. We published our corporate plan for 2021-27 in December 2020. The plan, which was agreed with Scottish Ministers, explains:

- our strategic objectives

- the outcomes we are setting out to achieve for customers, communities and other stakeholders

- the activities we will need to undertake to deliver these outcomes

- the resources necessary.

Our corporate plan focuses on our statutory obligations to current and future customers. It ensures that we contribute fully to delivering the water sector vision. This is particularly important given the need for Scottish Water to achieve net zero emissions by 2040 and to maintain service levels by repairing, refurbishing, and sustainably replacing the industry’s assets. Climate change often means that there is too much water in places we do not want it, and too little in the areas where we do. Scottish Water will play a crucial role in adapting to our changing climate.

OUR ORGANISATIONAL MODEL

Scottish Government sponsorship

WICS is sponsored by the Scottish Government’s Directorate for Environment, Climate Change and Land Reform. The Framework Document within our Governance Framework sets out how WICS and the Scottish Government (SG) work together, and the key roles and responsibilities of:

- The Commission Board;

- The CEO and Accountable Officer of WICS;

- The Scottish Ministers; and

- The Portfolio Accountable Officer within the SG whose remit includes WICS.

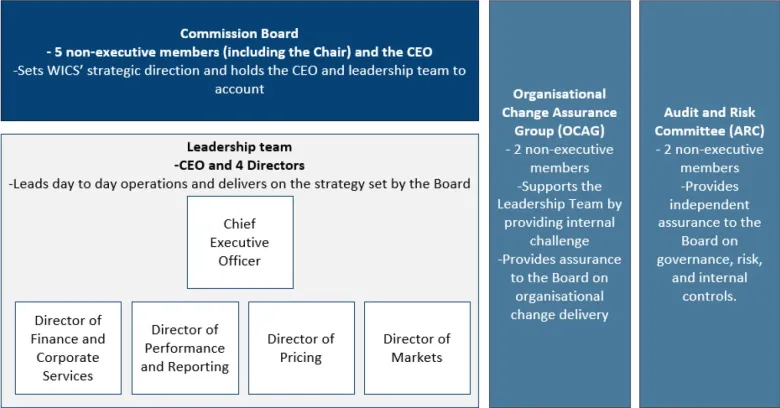

The Board and sub-committees

There have been several changes to WICS’ Board during the period from April 1, 2024, to March 31, 2025. At the beginning of the period, WICS’ Board comprised three non-executive members (including the chair) and the Chief Executive Officer. Thereafter, two interim members joined on 15 July 2024. Following the resignation of the Chair on 21 October 2025, an interim Chair was appointed. By the end of the period, WICS’ Board comprised two non-executive members, one interim non-executive member, the interim chair and the CEO.

During the period, there were two Board subcommittees: the ARC and the Organisational Change Assurance Group (OCAG). The governance statement within the Accountability Report covers further information about our Board Members and the role of our Audit and Risk Committee (ARC).

Funding

WICS is funded through a levy on Scottish Water and the retailers participating in the competitive non-household market. Scottish Ministers set the size of these levies in light of the objectives and key targets agreed through the corporate planning process.

Organisational structure and governance

This year, working towards a key deliverable in the organisational change programme, we reviewed and refined WICS’ organisational structure around four directorates:

The review began with restructuring the leadership team to create a more decentralised model, enabling clearer delegation of responsibilities, stronger collective decision-making, and improved accountability. This work was undertaken in collaboration with the Board and supported by frequent engagement with the Scottish Government Sponsor Team.

The new leadership team structure has already delivered efficiencies in remuneration costs, enabling reinvestment in addressing functional gaps and reducing reliance on consultancy support.

Our operating environment

We work closely with many stakeholders, and these relationships are summarised below.

Stakeholder |

Interaction with our work |

| Scottish Parliament | We are accountable to the Scottish Parliament through Scottish Ministers. |

| Scottish Government | The Scottish Government sets the overall objectives and principles of charging for the water industry in Scotland. |

| Scottish Water |

We have a duty to promote the interests of both current and future customers by making sure that:

|

| Scottish Environment Protection Agency (SEPA) | SEPA regulates Scottish Water’s performance in terms of compliance with environmental standards and investment in improvements. |

| Drinking Water Quality Regulator (DWQR) | The DWQR regulates Scottish Water’s compliance with drinking water quality and investment to protect public health. |

| Consumer Scotland | Consumer Scotland is the levy-funded advocacy body for Scotland’s water sector, established by the Consumer Scotland Act 2020 and accountable to the Scottish Parliament. It promotes positive consumer outcomes and engagement across household and non-household markets, covering service affordability, net-zero transition, and adaptation to climate change. |

| Central Market Agency (CMA) | The CMA administers the competitive non-household retail market. It is a separate organisation from the Competition and Markets Authority, a UK body, that ensures markets deliver appropriately for consumers. |

| Scottish Public Services Ombudsman (SPSO) | With responsibility for complaints and dispute resolution in the water sector, the SPSO provides insights into levels of trust and confidence among consumers. |

OUR ACHIEVEMENTS 2024-25

Our performance report summarises progress from 1 April 2024 to 31 March 2025, against objectives, outcomes, and KPIs in our Corporate Plan 2021–27. We refreshed our strategic objectives and outcomes in March 2025:

Our 2024-25 work plan: Delivering benefits for customers

Our annual work plan for 2024-25 focused on six key themes, each designed to ensure that the Scottish water sector continues to deliver high-quality services, best value and long-term sustainability for customers:

- Building an effective and efficient WICS – strengthening our organisation so we can regulate Scottish Water effectively, make informed decisions, and provide clear oversight that benefits customers.

- Delivering the Strategic Review of Charges 2027–33 (SRC27) – setting a fair and transparent framework for charges, ensuring customers pay no more than necessary for essential water and wastewater services.

- Monitoring and reporting on Scottish Water’s costs and performance – holding Scottish Water to account, scrutinising investment, and confirming that customer charges are spent efficiently to maintain and improve services.

- Improving the retail market framework – raising standards for business and public sector customers, ensuring they have access to high-quality services.

- Refocusing our engagement – we have paused international consulting activity, but we have continued to focus on knowledge sharing among regulatory networks.

- Strengthening our cyber resiliency – strengthening our systems and safeguards to protect our data and information.

In addition to these core activities, we delivered a wide-ranging organisational change programme focused on strengthening our organisational structure, governance, financial controls, and focus on our people.

This annual report highlights our progress against these themes. We have achieved almost all of the milestones in the 2024–25 work plan, with some initiatives continuing into 2025–26.

2024-25 AT A GLANCE

Theme 1: Building an effective and efficient WICS

We undertook a wide programme of organisational improvement to strengthen governance, accountability and value for money.

- Delivered a revised organisational structure based on four directorates, established a smaller leadership team and clarified roles and responsibilities.

- Embedded stronger governance processes, improved compliance reporting and redeveloped our risk management framework and reporting.

- Invested in people, introducing HR support, staff engagement, and leadership development.

- Introduced hybrid working.

- Supported the Scottish Government’s independent review of WICS and responded proactively and transparently to the PAC.

- Addressed all recommendations from the annual internal audit review.

- Delivered our statutory functions under budget, while maintaining a low cost to the sector—just 60p per person served.

- Total expenditure fell by over 10% compared to the previous year, reflecting improved efficiency across staffing, travel, and consultancy.

- Planning for a financial sustainability review for the next regulatory control period.

Theme 2: Delivering the Strategic Review of Charges 2027-33

Through the Strategic Review of Charges, we ensure that customers pay no more than necessary for essential water and wastewater services.

- Delivered the final SRC27 methodology, shaped by extensive consultation and stakeholder engagement.

- The methodology sets a clear framework for Scottish Water, embedding customer and community priorities in decision-making.

- It strengthens monitoring and assurance, ensuring future performance and investment can be tracked transparently.

- Delivered a new Memorandum of Understanding with Scottish Water and Consumer Scotland formalised customer involvement in the review, ensuring customer voices are heard throughout.

Theme 3: Monitoring and reporting Scottish Water’s costs and performance

- We made sure Scottish Water delivers the services and investment that customers fund.

- Scrutinised Scottish Water’s investment plans, service levels, and costs, and published our independent Performance Report for 2023–24.

- Revised regulatory accounting rules and financial modelling approaches to ensure greater transparency and consistency.

- Developed new monitoring metrics for 2027–33, strengthening how we hold Scottish Water to account in the next regulatory period.

Theme 4: Improving the retail market framework

We ensure the market works effectively for retailers and Scottish Water, and that business customers and public bodies receive better value from their water services.

- Introduced a collaborative Code of Practice developed with licensed providers, Consumer Scotland, Scottish Water, and the CMA. It sets out clear, measurable service standards to promote transparency and accountability across the market.

- We are pioneering the Market Health Check: an independent, voluntary assessment process that verifies licensed providers uphold meaningful service commitments. Accreditation will be published publicly, giving customers confidence in the quality of providers and raising overall market standards.

- Consulted on Business Stream’s governance code, reopened the licence application process, and updated assurance processes to raise standards across the market.

- Together, these initiatives raise the bar across the market and demonstrate our commitment to customer-focused oversight of the market.

Theme 5: Contributing to Hydro Nation

Clarified expectations of WICS Hydro Nation Duty with Scottish Government (February 2025) and paused revenue-generating work, having exceeded a minimum annual net contribution to our income from this work of £300,000.

Theme 6: Strengthening our cyber resiliency

We also renewed our Cyber Essentials Plus accreditation, strengthening resilience against cyber risks.

OUR KEY CHALLENGES AND RISKS

The most pressing challenge in 2024–25 was addressing the Section 22 report and rebuilding trust with key stakeholders and the wider public. While this remains an ongoing journey, we have made significant changes to restore confidence in WICS as a public body and economic regulator that delivers best value. This has included responding transparently to the Scottish Government’s independent review of WICS and the PAC’s scrutiny, while fulfilling our core regulatory responsibilities.

Resourcing pressures also represented a significant challenge, with a notable number of vacancies across the organisation, including at leadership and Board level. Considerable effort was dedicated to recruitment and implementing a revised organisational structure to ensure WICS can deliver its role efficiently and effectively.

Wider developments in the water sector, including the Independent Water Commission’s review of England and Wales, have increased scrutiny and focus on the industry. These developments present both challenges and opportunities for WICS and the broader Scottish Water sector, which we will continue to monitor as we enter 2025–26.

A key part of the organisational change programme was to revise and embed a new risk management framework. This was predominantly in response to the Section 22 report, but also timely given wider risks, including the impact of COVID-19, sustained high inflation, and the need to ensure confidence in governance and controls.

In 2024–25, we reshaped our approach to risk management. A workshop in September 2024 identified and assessed key risks, followed by a mapping exercise to reconcile the old and new risk registers. This ensured a clearer alignment between risks and WICS’ strategic objectives. Towards the end of the year, we gave greater focus to mitigation and assurance mapping, beginning to link risks to sources of assurance and to test the adequacy of existing controls. The ARC and the Board supported this work, approving a revised risk management framework in May 2025. This programme will continue into 2025–26 as WICS develops a more mature, embedded, and transparent approach to managing risk.

More information on our key risks and their impact on delivering our outcomes can be found in the risk section of the performance analysis.

1.4 Performance analysis

PERFORMANCE AGAINST KEY OUTCOMES

Our 2024–25 annual work plan sets out the priority areas we would focus on to make progress against the three strategic objectives and nine outcomes in our 2021-27 corporate plan.

Work plan priorities and how they contribute across our nine outcomes

2024-25 work plan priorities |

Delivering against objectives and outcomes |

|

| 1.An effective and efficient WICS | Strategic objective 3 | Outcomes 8 & 9 |

| 2. Strategic Review of Charges 2027-33 | Strategic objectives 1 & 2 | Outcomes 1, 2, 4, 5 & 6 |

| 3. Scottish Water's cost and performance | Strategic objective 2 | Outcomes 2, 4 & 5 |

| 4. Retail market framework | Strategic objective 1 | Outcome 3 |

| 5. Contribution to Hydro Nation | Strategic objective 3 | Outcome 7 |

| 6. Cyber resiliency | Strategic objective 3 | Outcome 8 |

Our progress is outlined in the section below:

Outcome 1: Supporting Scottish Water to be sustainable over the long term

This year, our primary focus has been on developing our draft and final methodology for the Strategic Review of Charges 2027-33 (SRC27). This work establishes the framework within which Scottish Water will operate during the next regulatory control period, ensuring that customers continue to pay no more than necessary for vital water and wastewater services.

Our methodology provides a clear basis for Scottish Water to deliver high-quality services and make the long-term investment needed to maintain Scotland’s water infrastructure. It puts customer and community engagement at the heart of the process, ensuring that the views and priorities of customers shape the charging decisions we make. The final methodology was shaped through meaningful stakeholder engagement, including a public consultation, to ensure transparency and broad support for our approach.

Alongside our methodology, we consulted on and published a set of detailed data tables, guidance and definitions for Scottish Water to complete as part of its business plan, which was submitted in draft to WICS in June 2025. Importantly, these requirements enhance our ability to monitor Scottish Water’s performance, with a heightened focus on data quality and assurance throughout the 2027–2033 period.

Outcome 2: Incentivising an efficient and effective Scottish Water

Throughout 2024–25, we continued to closely monitor Scottish Water’s performance, holding it accountable for delivering the levels of service and investment funded by customers. In November 2024, we published our 2023–24 Performance Report, providing a clear, evidence-based assessment of Scottish Water’s progress.

Our report found that Scottish Water is broadly performing in line with the requirements of the Final Determination. We welcomed improvements in investment delivery, which has returned to within its target range. However, we highlighted concerns that the total investment over the period is likely to be around £500 million lower than initially assumed when the charge caps were set. We also identified areas where performance fell short of Scottish Water’s own targets, including completion of some projects carried over from previous regulatory periods, leakage levels, and its new developer Customer Experience Measure. We will continue to closely monitor progress in these areas.

In early 2025, Scottish Water published its draft long-term strategy, Our Sustainable Future Together, for consultation. We carefully reviewed the strategy and provided detailed feedback. In doing so, we highlighted the need for Scottish Water to underpin its projections with clear, comprehensive, and robust evidence. We also raised a series of critical questions to ensure the strategy is analytically sound, transparent, and aligned with the shared sector vision.

Looking ahead, we will continue to engage constructively with Scottish Water as it develops the evidence and analysis underpinning its detailed investment strategy and draft business plan for 2027–33.

Outcome 3: Helping ensure that the retail market maximises benefits for customers

Scotland’s retail non-household water market continues to offer businesses, public bodies and charities greater choice, tailored services and improved value. Our priority this year has been to ensure the market continues to deliver meaningful benefits for customers by strengthening standards and enhancing trust in the services provided.

Working closely with licensed providers, Scottish Water, Consumer Scotland and the Central Market Agency, we have developed a new Code of Practice for the market. This sets clear service commitments that go beyond minimum licence requirements and will ensure customers can expect consistently high standards from their chosen provider. Alongside this, we have introduced an innovative Market Health Check to build customer confidence and provide assurance that commitments are being met.

We have also taken steps to ensure the market remains open, fair and competitive. We reopened the licence application process following a comprehensive review of requirements for new entrants. We launched a public consultation on the implementation of the Code of Practice and governance arrangements for Business Stream, aiming to support a level playing field for all participants.

Through these actions, we are ensuring that the Scottish retail market continues to evolve in a way that maximises benefits for customers. Looking ahead, full implementation of the market health check assurance process will provide greater confidence that providers are delivering to the standards we expect.

Outcome 4: Supporting Scottish Water to become an analytically driven organisation that takes full account of benefits and costs

A key priority for WICS is to ensure that Scottish Water bases its decisions on robust analysis, with a clear understanding of costs and benefits for customers. Over the past year, we have worked to strengthen the requirements for the quality, consistency and transparency of the regulatory information Scottish Water provides.

We saw a further improvement in the annual return 2023-24, with Scottish Water providing clearer and more comprehensive explanations and fewer queries required (a 15% decrease in the overall number of queries compared to last year). This helps build confidence that the information underpinning decisions is accurate and reliable.

Together with Scottish Water, we also completed the development of a joint financial model for the next Strategic Review of Charges. This model, independently reviewed and validated, will provide a sound basis for assessing future investment needs and ensuring value for money.

In addition, we introduced revised regulatory accounting rules and developed new business plan data tables to ensure Scottish Water’s future plans are built on a clear and consistent baseline.

Through these steps, WICS is challenging Scottish Water to become a more analytically driven organisation – one that can make well-evidenced decisions in the long-term interests of customers.

Outcome 5: Acting as a hub of information and expertise to support decision-making

In 2024–25, WICS continued to act as a centre of knowledge and expertise, supporting informed decision-making across Scotland’s water industry. As part of our final methodology and business plan guidance, we published a wide range of outcome measures for 2027–33, providing a clear central framework for all stakeholders and customers to track Scottish Water’s progress and performance. Over 2025–26, we will build on this by developing the future monitoring regime, aligned with water industry investment group governance for the next regulatory period. This group, underpinned by the regulatory information framework, will act as the central forum where the industry can monitor Scottish Water’s performance over the 2027-33 regulatory control period.

Our wide and detailed understanding of regulatory frameworks and approaches in other countries enables us to identify areas of best practice or innovation in asset-intensive industries, which we can apply to benefit Scottish Water and its customers.

This year, we continued to share knowledge and expertise nationally and internationally. We organised a study tour for officials from Sabah State in Malaysia, offering participants an in-depth view of Scotland’s regulatory framework, including engagement with Scottish Government officials, Scottish Water, and Business Stream. This event provided a valuable opportunity to showcase Scotland’s water sector expertise and exchange knowledge.

We also continued participating in the OECD’s Network of Economic Regulators (NER), learning from and sharing expertise with others across this network. These activities ensure WICS remains at the forefront of regulatory best practice, helping secure better customer outcomes and supporting sustainable investment in Scotland’s water sector.

Outcome 6: Promoting customer-centric decision making

Putting customers at the centre of decision-making is vital to ensure that water services and charges reflect the needs of the people and communities they serve. In late 2024, WICS formalised a collaborative approach to placing customers at the heart of the Strategic Review of Charges 2027–33 (SRC27) through a new Memorandum of Understanding (MoU) with Scottish Water and Consumer Scotland. Signed on 1 November 2024, the MoU provides a clear framework for involving consumers throughout the review, ensuring their views help shape Scottish Water’s business plan and inform WICS’ Final Determination of charges.

The MoU establishes three pillars of work: evidence, challenge, and confirmation. Independent research provides the evidence for the Independent Customer Group to challenge Scottish Water’s proposals, while the confirmation stage tests whether consumers support the final business plan.

This agreement strengthens customer engagement in the price review process, helping us ensure that decisions on water charges reflect customer priorities and maintain public confidence in Scotland’s water services.

Outcome 7: Acting as a leading communicator, influencing and collaborating with others to deliver our regulatory approach

In 2024-25, we took key steps to strengthen our role as a trusted voice in the water sector. We recognise that clear communication and meaningful engagement are essential regulatory tools. Our work in this area ensures that stakeholders understand WICS’ role and value, ultimately helping to deliver better outcomes for customers.

We clarified our Hydro Nation Duty with the Scottish Government, pausing revenue-generating activity, whilst maintaining space for valuable knowledge sharing that informs our core regulatory work.

We successfully delivered wide-ranging engagement on our Strategic Review of Charges methodology, publishing the draft consultation and promoting it across channels to ensure stakeholders had a clear voice in shaping the future of the regulatory framework. This year, we have also begun planning communications to support our draft and final determinations of charges, which will be key in explaining their impact on customers.

WICS also contributed Scottish insights to the Independent Water Commission’s review of regulation in England and Wales, highlighting the benefits of Scotland’s approach: clear accountability, public ownership, and a strong focus on long-term investment and customer value.

We continued to engage audiences through media and events, including our Chief Executive’s contribution to the Wise on Water podcast, which showcased how effective regulation can deliver greater resilience for customers and the environment.

Looking ahead, we will continue to grow our reach and impact as a communicator, using engagement to deliver independent and customer-focused economic regulation.

Outcome 8: Ensuring that the office operates efficiently and in line with our duties and obligations as a public body

This year has been transformational for WICS. We have taken significant steps to strengthen our operation as a public sector body and economic regulator. We have responded fully to the findings of the Auditor General and the PAC with a comprehensive programme of reform, designed to strengthen governance, improve transparency, and embed a culture of value for money.

The result is that the WICS of today is a very different organisation: one with stronger governance, clearer decision-making, and a culture built upon openness and accountability. These changes reflect both our commitment to responsibility as a public body and our resolve to ensure that Scottish customers benefit from an efficient and effective economic regulator.

We actively supported the Scottish Government’s independent review of WICS, published in November 2024. We responded fully and transparently to the PAC following evidence sessions in March and September. We have addressed various issues, including governance and transparency, as well as value for money practices. We hope our proactive and constructive engagement has helped strengthen confidence in WICS and our important role for water customers in Scotland. We understand that trust is earned, and we are committed to demonstrating, through our actions, that WICS is an efficient and responsible public body.

Revising our governance framework has been an important milestone this year in our organisational reform journey. We worked closely with the Scottish Government to agree on a revised Framework Document, which strengthens the foundation of how we are governed and held accountable.

Cyber resilience has remained a priority. In June 2024, we successfully renewed our Cyber Essentials Plus accreditation, reviewed our IT security policy, and delivered annual cyber awareness training for all staff and Board members. We have also strengthened Board-level oversight by appointing a dedicated cyber resilience advocate.

Internally, we have strengthened internal policies, embedded a clearer people focus, and invested in leadership and staff development. We introduced permanent HR support, strengthened staff engagement through regular surveys, and moved to a hybrid working model supported by shared office space.

Overall, this year's progress marks a significant step forward in how WICS operates. These changes mean WICS is better equipped to operate at the forefront of what is expected of a modern, accountable public body and economic regulator.

Outcome 9: Demonstrating best value in all that we do

As a public body, we are acutely aware of our obligations to deliver value for money, and we acknowledge that this has not been demonstrated sufficiently in the past. This year, our focus has been on reviewing our organisational structure, roles, and governance model to ensure that resources are used efficiently and deliver maximum benefit to water customers in Scotland.

We restructured our leadership team into four directorates, creating a smaller, more accountable senior structure. Pay bands for the Chief Executive and Directors were brought more closely into alignment with public sector benchmarks, delivering recurring savings of around £240k and creating space to reinvest in building capacity and improving our work.

To further enhance operational efficiency, WICS has implemented measures to utilise shared services more effectively. The first stage of this approach has involved utilising Scottish Government procurement frameworks to reduce overheads across various functions, including interim professional services, IT, and other support areas.

We have also reduced reliance on external consultancy, bringing key work — including the methodology for the Strategic Review of Charges 2027–33 — in-house. This has built internal capability and delivered significant savings.

As part of this change, WICS has returned to Moray House, where a shared services agreement with another non-departmental public body will allow for more effective use of physical and support resources. To ensure business continuity in the interim, we intend to extend our lease with Stirling Council, providing the necessary time to engage meaningfully in the Single Scottish Estate programme and assess our longer-term accommodation needs.

These measures are underpinned by stronger financial controls, revised compliance reporting to the leadership team, Board and ARC, and a programme of internal audits that have confirmed substantial improvements since December 2023

These organisational changes have been overseen by a sub-committee of the Board, ensuring appropriate scrutiny and alignment with our wider governance model.

Looking ahead, we have initiated a financial sustainability review to project our cost base and operational needs over the medium term. This work will inform the development of our next Corporate plan for the 2027–33 regulatory period, helping us to plan with greater certainty and transparency.

WICS now operates with greater financial discipline, increased transparency, and a stronger focus on delivering efficiency and public value.

ORGANISATIONAL CHANGE

Since December 2023, WICS has delivered a wide-ranging reform programme. These changes have made us more effective and better equipped to provide long-term value for Scotland’s water customers.

Our transformation at a glance

Strengthening financial controls and assurance

We have embedded stronger financial stewardship at the core of WICS.

- A revised scheme of delegation now clearly sets out the roles of the board and executive.

- Financial policies covering expenses, procurement, training and fraud prevention have been comprehensively overhauled.

- Cross-functional approvals are now required for all significant expenditure.

- All 2022/23 audit recommendations have been implemented, and most 2023/24 recommendations are substantially complete.

- Audit Scotland and two independent internal audit providers have each acknowledged the progress WICS has made since December 2023.

Strengthening governance and leadership

We have reset the way leadership and governance work together.

- A distributed leadership model has been introduced, restoring clear governance and decision-making.

- A revised Framework Document, agreed with the Scottish Government, now clarifies responsibilities and expectations.

- A new four-directorate leadership structure has been established through open competition.

- Comprehensive induction and training programmes ensure that both Board Members and staff are equipped to deliver their responsibilities, with modules in cyber security, fraud, procurement and whistleblowing.

Resetting our sponsorship relationship

We have built a more open and transparent relationship with the Scottish Government as our sponsor.

- A revised framework ensures clearer and more proportionate oversight, while preserving WICS’s independence as a non-departmental public body and economic regulator.

- Government colleagues now attend some Board meetings as observers.

- These changes align fully with the Ryan Review principles of trust, mutual respect and outcome-focused accountability.

Demonstrating a change in operating practice

Our day-to-day operations now reflect efficiency, sustainability and value for money.

- An in-house HR function has been re-established, supported by revised policies and a new training and development framework.

- A hybrid working model and the use of shared services (procurement frameworks, facilities management) have reduced costs and improved flexibility.

These actions contributed to a strong financial position at year-end, ensuring WICS is financially sustainable for the future.

Strengthening people, culture and accountability

We have invested in the people and culture that underpin our success.

- Board capability strengthened through a revised induction programme and refresher training on governance, accountability and public finance responsibilities.

- Mandatory staff training rolled out across key areas (cyber security, fraud awareness, procurement, whistleblowing, and value-for-money).

- New training policy introduced, with clear lock-in clauses to ensure WICS and the public benefit directly from investment in staff development.

- Whistleblowing arrangements enhanced, with clearer internal and external reporting routes and independent assurance from internal audit.

- Regular staff surveys and workshops established, creating new channels for staff to raise concerns, influence culture and shape organisational development.

- In-house HR function embedded, with revised policies and a new appraisal system linking individual objectives directly to organisational goals.

- Culture of transparency and accountability reinforced through regular communication, Board oversight of reforms and active staff engagement throughout the reset process.

Looking ahead

The reforms are embedded, and WICS is now operating with:

- Clearer accountability

- Disciplined financial management

- Strengthened internal capacity

- Improved transparency and trust

This transformation provides a solid platform for delivering on our statutory role—ensuring that Scotland’s water industry is regulated efficiently and in customers’ best interests.

KEY PERFORMANCE INDICATORS

Our corporate plan identified 11 key performance indicators (KPIs) against which we measure the success of delivering our nine outcomes over the regulatory control period. We identified the key KPIs for this financial year, and our performance against each is described in detail in this section.

In March 2025, we revised some of these KPIs in light of key changes made within the organisation following the section 22 report, particularly to ensure consistency with the decision to pause revenue generating international projects.

The KPIs we delivered against for this financial year are outlined in the table below, along with an analysis of how we performed against those indicators.

Outcome(s) |

KPI |

Performance during 2024-25 |

| 8 | By February of each year of the corporate plan period, we will set out in an annual workplan the activities which we will undertake during the year. In the following year our Annual Report will include information on progress against our workplan. | The Board approved our 2024-25 work plan in April 2024. Regular updates on the work plan are provided to the Board at each board meeting. These updates have informed the performance summary in this annual report. |

| 1-3 | We will implement a regulatory framework that enables and supports Scottish Water to take full ownership of its relationship with customers and its decision making. We will report annually to the Board, and in our statutory annual report and accounts, on progress. |

Delivered. Our methodology for SRC27 published in December 2024 provides the framework for customer involvement. We report in outcome 6 above the action we have taken to introduce an MoU between WICS, Scottish Water and Consumer Scotland. |

| 1-3 | By November of each year, we will publish our annual reports on Scottish Water’s overall performance in delivering the requirements set out in the 2021-27 final determination and identify any gaps that have the potential to impact on the level of trust among stakeholders. |

Delivered. Our assessment of Scottish Water’s 2023-24 performance was published in November 2024. |

| 3 | Working with licensed providers, we will seek to put in place by December 2024 effective measures which ensure that all licensed providers have appropriate financial resilience. | Delivered. |

| 3 | By April 2023 we will introduce a voluntary market-wide process that allows licensed providers to demonstrate behaviours consistent with EBP. | Delivered. Our Code of Practice is now in place, as reported under outcome 3 above. |

| 4-6 | Our annual reports on Scottish Water’s overall performance will include an assessment of its progress in ensuring that project appraisals encompass a full assessment of the economic costs and benefits of investment. This assessment should include aspects such as the carbon impact, and of natural and social capital. |

Not yet met. It is more appropriate to cover this KPI in the SRC27 draft determination when reviewing Scottish Water’s appraisals. Moving forward, this KPI will be revised: “Our draft determination will include an assessment of Scottish Water’s project appraisals and encompass a full assessment of the economic costs and benefits of investment. This assessment should include aspects such as the carbon impact, and of natural and social capital.” |

| 7 | We will report annually on requests for regulatory advice and information and expertise from industry stakeholders and international partners, and on the nature of support we have provided. |

Delivered. As reported in under outcome 7 above, during the period we hosted a study tour from Sabah State and engaged with the Independent Water Commission’s review of the water sector in England and Wales. |

| 4-6 | Our annual reports on Scottish Water’s overall performance will include an assessment of its progress in ensuring that customers and communities are involved in decision making. This will encompass assessing the extent to which customers could reasonably have confidence that their views are being heard and acted upon. |

Not yet met. It is more appropriate to cover this KPI in the draft determination in our view of the approach taken to customer involvement. Moving forward, this KPI will be revised: “Our draft determination will include an assessment of Scottish Water’s progress in ensuring that customers and communities are involved in decision making. This will encompass assessing the extent to which customers could reasonably have confidence that their views are being heard and acted upon.” |

| 7 | We will support the Scottish Government’s Hydro Nation initiative by delivering projects and assistance, providing a minimum annual net contribution to our income from this work of £300,000. | Delivered and exceeded by 2023-24. |

| 8 | We will ensure that our income and costs remain within budget targets over the regulatory control period and will report our financial performance on a regular basis to the Commission Board. | Delivered. In line with the corporate plan and budget, we delivered our priorities in 2024-25. For more information on the financial results for the year, see the section on financial performance. |

| 9 | We will achieve the desired structure for the office by 2025 and ensure that progress remains on track in the interim. | Delivered. We have delivered a revised organisational structure for WICS as reported under outcome 9. |

Looking ahead, we have revised our KPIs further for the 2024-25 period:

Outcome(s) |

KPI |

Directorate |

2025-26 |

2026-27 |

| 8 | By March of each year of the corporate plan period, we will set out in an annual workplan the activities which we will undertake during the year. In the following year, our Annual Report will include information on progress against our workplan. | F&CS | X | X |

| 1-3 | By November of each year, we will publish our annual reports on Scottish Water’s overall performance in delivering the requirements set out in the 2021-27 final determination and identify any gaps that have the potential to impact on the level of trust among stakeholders. | P&R | X | |

| 3 | We will introduce a market health check process that allows licensed providers to demonstrate behaviours consistent with EBP. | Markets | X | |

| 4-6 | Our draft determination will include an assessment of Scottish Water’s project appraisals and encompass a full assessment of the economic costs and benefits of investment. This assessment should include aspects such as the carbon impact, and of natural and social capital. | Pricing | X | |

| 4-6 | Our draft determination will include an assessment of Scottish Water’s progress in ensuring that customers and communities are involved in decision making. This will encompass assessing the extent to which customers could reasonably have confidence that their views are being heard and acted upon. | Pricing | X | |

| 8-9 | We will ensure that our income and costs remain within budget targets over the regulatory control period and will report our financial performance on a regular basis to the Board. | F&CS | X | X |

PRINCIPAL RISKS

During 2024–25, we faced several principal risks which reflected both the legacy of organisational change and the demands of our regulatory role. The most significant themes were as follows.

Governance and organisational resilience

Strengthening governance arrangements and embedding cultural change remained a priority. While progress was made through revised structures and clearer roles, the risk of reputational harm and loss of confidence was carefully managed.

Financial management and compliance

Demonstrating strong financial control was a central risk, particularly in light of previous audit findings. Financial policies and procedures were strengthened further, and compliance improved significantly, although it remains under active monitoring.

Cybersecurity and data protection

Cyber risk has been consistently assessed as high, reflecting the wider external threat environment. Regular reporting from the Head of IT, along with investment in cyber resilience measures, provided assurance; however, vigilance will remain necessary into 2025–26.

Regulatory delivery

Given its importance to customers and stakeholders, the Strategic Review of Charges 2027–33 presented operational and reputational risks. Robust project governance and close engagement with Consumer Scotland and Scottish Water mitigated these risks during the year.

People and organisational capacity

The demands of implementing change placed pressure on staff capacity and morale. Targeted HR support and staff surveys helped the leadership team respond to concerns, but this will continue to be a focus as the organisation adapts.

Fraud and assurance improvements

A fraud risk assessment in early 2025 highlighted cyberfraud as the most significant exposure area. Work began on assurance mapping to ensure that risks are matched with reliable sources of assurance, and this programme will continue as a routine activity.

These risks underline the importance of embedding a more mature risk management culture. The measures introduced in 2024–25 reduced some exposures, but several remain live and will require ongoing attention in 2025–26.

FINANCIAL PERFORMANCE

We prepare a detailed annual budget that aligns with the corporate plan and submit it to the board for approval. We use a comprehensive budgeting and financial reporting system, which aligns with the Scottish Public Finance Manual (SPFM), to compare actual results to the budgets approved by the board. Management accounts are prepared each month, with significant variances from the budget investigated and reported. Cash flow and other financial forecasts are prepared regularly throughout the year to ensure that WICS has sufficient cash to meet its operational needs.

Financial performance 2024-25

As set out in the financial statements, the net operating surplus for the year was £970,451 (2023-24, restated: £803,107) before interest received, corporation tax payable and any adjustments for actuarial gains or losses.

The total income received for the year was £4,134,420 (2023-24: £4,519,241). The income received from Scottish Water aligned with the corporate plan. The levy on licensed providers remained unchanged for another year, reflecting a decrease against the corporate plan in support of the continued delivery of the Market Health Check.

No international income was received during the year. This reflects the Scottish Government’s decision to pause international activity, allowing WICS to reset its strategic focus. In contrast, international income in 2023–24 is related to the final stages of project work in New Zealand.

Rental income from the sub-lease decreased by £28,420 to £91,594 (2023-24: £120,014). This reduction reflects Zero Waste Scotland’s renunciation of the sublease from 1 January 2025, with the move to a shared occupancy agreement between the two organisations.

The financial year 2024-25 expenditure was £3,163,969 (2023-24, restated: £3,716,134). Travel and subsistence costs totalled £22,793 in 2024–25, a significant reduction from £162,015 in the previous year. The most significant contributing factor to this decrease was the cessation of international business development activity. In 2023–24, £107,336 of travel expenditure was related directly to international engagement. No such activity occurred in 2024–25 following the Scottish Government’s decision to pause international work. Additionally, domestic travel was reduced considerably.

During the year, we continued the restructure of our leadership team, with the wider organisational restructure progressing through 2025–26. These changes will not be fully embedded until the end of the 2025–26 financial year. In the interim, savings have been realised from vacant posts, meaning colleagues carry a broader range of responsibilities. It was, however, essential to ensure the new structure was carefully designed to support the organisation’s future needs. As a result, remuneration costs were around £232k lower than the internal budget.

We also adopted a more disciplined approach to using external consultants. While maintaining some service contracts for specialist economic and legal support, we undertook a more rigorous review of consultancy requirements. Where appropriate, we competitively tendered our consultancy requirements to ensure value for money and the right expertise was obtained. Consequently, expenditure on consultants was just under £300k, compared with the £775k set out in the budget.

The internal budget agreed by the Board at the start of the financial year projected a net expenditure position of £125,606. This reflected the use of surpluses generated earlier in the regulatory period (2021–27), which had created a high cash balance to be applied in later years. Excluding corporation tax, depreciation, bank interest and IAS19 adjustments, the actual year-end position was a net surplus of £1,243,546 – an increase of £1,369,151 on the budgeted position.

We recognise that this year's expenditure levels are not sustainable in the longer term. Once the organisational change programme has been completed, our staff complement will increase, and remuneration costs will rise accordingly. These issues, alongside wider cost pressures, are being addressed as part of our financial sustainability review.

Accommodation will also need to be considered. Our current lease on office space expires in March 2026. In recent years, we have sublet part of our office to Zero Waste Scotland, and during the past year, we have shared the space with them. This has proved to be an effective use of resources and demonstrates the benefits of collaboration with another NDPB. Looking ahead, we anticipate that a combination of space-sharing with other organisations, alongside a balance of office and home working, will offer the most efficient and sustainable approach.

We also reviewed IT expenditure during the year, for example, by using the Scottish Government’s mobile contract and optimising hardware requirements. Combined with previous work to migrate all IT infrastructure to the cloud, these measures deliver ongoing annual savings of around £75k.

The reserves balance on 31 March 2025 was £5,758,223 (2023–24 restated: £4,593,064), reflecting the surplus generated in the year. Surplus cash continues to be deposited in a higher-interest-earning treasury deposit account. This approach generated £122,180 in bank interest during the year (2023–24: £84,632). As part of the financial sustainability work underway in 2025–26, we will review the high cash balance and develop a sustainable approach to managing reserves and future cash requirements.

Supplier payment policy and performance

Our policy is to pay all supplier invoices not in dispute within the terms of the relevant contract and as soon as possible following receipt. In line with Scottish Government guidance, we aspire to meet a 10-working-day target for paying bills to businesses in Scotland. Prompt payment is a key objective and a reflection of our commitment to supporting our suppliers.

In 2024-25, the average time to pay suppliers was 8 days (2023-24: 6 days). Performance against payment targets is summarised below:

Time taken to pay |

2024-25 |

2023-24 |

| Within 10 days | 72% | 95% |

| Between 11 and 30 days | 27% | 4% |

| More than 30 days | 1% | 1% |

All invoices are received electronically and processed through a standard workflow. This includes verification against purchase orders, confirmation of goods or services received, and approval for payment in line with delegated authority. Payments are made on a weekly cycle.

During the year, approval times were affected by resourcing constraints at senior levels, with a small leadership team having to take on a broader range of responsibilities. As a result, approvals were sometimes more cautious and took longer to complete, contributing to the lower proportion of invoices settled within 10 days.

We continue to review and refine our internal processes to ensure that payments are made promptly and that we provide timely and appropriate support to our suppliers.

WICS fully complies with the requirements of the Late Payment of Commercial Debts (Interest) Act 1998. No interest was paid under this legislation in 2024-25 (2023-24: none).

The Public Services Reform (Scotland) Act 2010

The Public Services Reform (Scotland) Act 2010 imposed duties on the Scottish Government and public bodies such as WICS to publish specific information about their expenditure. The Act requires us to publish two statements outlining our steps to promote and increase sustainable growth, as well as improve efficiency, effectiveness, and economy. The purpose of publishing this information is to encourage greater openness and transparency. We publish a report on our website setting out our response to the requirements of the Act.

SOCIAL MATTERS

Our statutory purpose is designed to deliver environmental, social and economic success. We take our social responsibility seriously and ensure that all staff policies and procedures are up-to-date and comply with the latest legislation.

ANTI-BRIBERY AND CORRUPTION

As part of our zero-tolerance approach towards fraud, bribery, and corruption, we have an employee code of conduct, a whistleblowing policy, and clear policies regarding acceptable levels of gifts and hospitality (both given and received). We actively encourage staff to be aware of and adhere to appropriate behaviours with customers and suppliers. We maintain a register of gifts and hospitality.

No frauds were detected in 2024-25.

We take malpractice very seriously and are committed to conducting our business honestly. We encourage open communication from all employees and want everyone to feel secure about raising concerns.

Our internal whistleblowing policy encourages and enables employees to raise concerns confidentially. All staff are protected under whistleblowing laws when they raise issues in accordance with the policy.

We also have an external whistleblowing policy, which aims to assist contractors and the general public, should they need to raise concerns about the water industry in Scotland.

We received one external whistleblowing report concerning Scottish Water during this reporting period. We launched a thorough investigation into the complaint, which involved engaging with Scottish Water and other relevant industry stakeholders. Our final report was issued alongside supporting evidence, and the matter was successfully closed.

We remain vigilant in addressing instances of whistleblowing and will continue to ensure that they are handled appropriately and in full compliance with our obligations.

TRANSPARENCY OF INFORMATION

We aim to be open in everything we do. Our default approach is to publish information about our activities on our website whenever possible. We also maintain a public-facing disclosure log to accommodate freedom of information requests. We also regularly engage with industry stakeholders and transparently set out our approach and decisions through published papers.

COMPLAINTS

We value and recognise the learning that complaints can generate and use complaint information to help us improve our services. No complaints were received during the 2024-25 period.

OUR SUSTAINABILITY PERFORMANCE

While our direct environmental footprint is small, WICS recognises that sustainability encompasses environmental, social and governance (ESG) factors. In line with the Government Financial Reporting Manual (FReM) requirements (paragraphs 5.4.7–5.4.16), we report on how we integrate these considerations into our strategy, operations and risk management to deliver long-term value for the public.

Environmental

WICS continues to embed environmental responsibility across its operations, with a focus on minimising carbon emissions, reducing waste and promoting efficient resource use.

- Greenhouse gas emissions: our principal source of emissions is business travel. The increase in in-person meetings has led to a corresponding rise in travel-related emissions, from 0.6 tonnes CO₂ in 2023–24 to 4.5 tonnes CO₂ in 2024–25.

- Home-working emissions: based on DEFRA guidance and typical energy usage, our estimated home-working footprint for 2024–25 is 8.9 tonnes CO₂e.

- Energy and resources: as part of our shared accommodation arrangement, we benefit from renewable energy contracts and modern, energy-efficient facilities. Paper and printing usage have been significantly reduced through the introduction of paperless meetings and digital workflows.

- Waste and recycling: all waste is segregated for recycling where possible, and we continue to work with our accommodation partner to ensure environmentally responsible waste management.

Social

We are committed to fair work, equality and staff wellbeing, ensuring WICS remains an inclusive and supportive workplace.

- Workforce and equality: as at 31 March 2025, 55% of our workforce and 50% of our board members were female. Recruitment and promotion follow fair work principles, and pay structures are aligned with Scottish public sector benchmarks.

- Wellbeing and engagement: our hybrid working model supports flexibility and work–life balance. Regular staff surveys and engagement sessions help shape our organisational culture and identify areas for improvement.

- Learning and development: all employees completed mandatory training in 2024–25 on equality, fraud awareness, whistleblowing, procurement, and cyber security. A new appraisal process links individual objectives directly to corporate outcomes.

Governance

Strong governance underpins our sustainability approach.

- The Board and Audit and Risk Committee oversee sustainability performance through our risk management and assurance framework.

- ESG considerations are embedded in our corporate risk register and linked to our strategic objectives on value for money, efficiency and resilience.

- Our procurement policy applies whole-life costing and requires suppliers to demonstrate sustainable and ethical practices, in line with the Scottish Government’s Sustainable Procurement Duty.

- The revised Framework Document agreed with the Scottish Government in 2025 further clarifies accountability and reinforces transparent decision-making.

Looking ahead

In 2025–26, WICS will:

- Develop enhanced reporting on social and governance indicators aligned with the public sector sustainability reporting framework.

- Continue to promote shared accommodation and collaboration with other public bodies to reduce costs and environmental impact.

- Publish an annual sustainability statement summarising progress against our environmental and social objectives.

David Satti

Chief Executive Officer