About this document

This report sets out WICS’ assessment of Scottish Water’s performance in the financial year 2024-25, the fourth year of the 2021-27 regulatory control period.

The report covers six areas:

- WICS’ role in the Scottish water industry;

- How WICS performs this role;

- Charges and expenditure;

- Delivery of the investment programme; and

- The delivery of key outcomes for customers and the environment.

Executive Summary

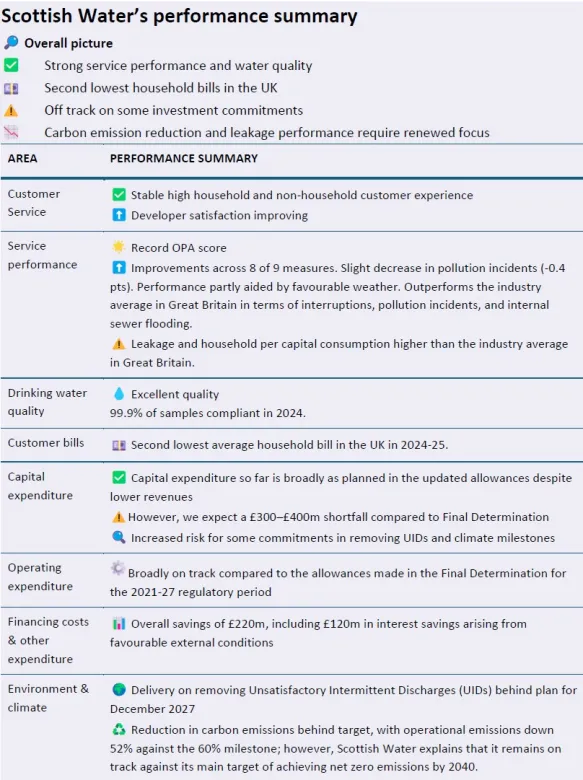

The Water Industry Commission for Scotland (WICS) is the economic regulator of the Scottish water industry. Each year, we publish an assessment of Scottish Water’s overall performance against the forecasts made during our Final Determination of Charges for the period 2021-22 to 2026-27 and against performance in previous years. This report assesses Scottish Water’s performance in the financial year 2024-25, the fourth year of the six year regulatory control period.

For this performance report, we compare Scottish Water’s reported performance in 2024-25 against:

- the allowed-for expenditure from the Final Determination;

- Scottish Water’s measures of progress in delivering the investment programme, levels of service, water quality and environmental performance; and

- Scottish Water’s past performance.

Overall assessment

Scottish Water has maintained strong performance in service levels, reporting its highest-ever performance across key aspects of service delivery. Scottish Water continues to deliver high levels of investment, despite not raising bills to the maximum level available from 2021-22 to 2024-25. However, we are starting to observe a slippage in a small number of areas where Scottish Water has made commitments beyond the 2021-27 regulatory period, including in relation to the removal of unsatisfactory intermittent discharges and climate change targets. We continue to monitor these areas closely, working closely with other industry stakeholders.

As noted in our previous reports, due to raising bills more slowly than assumed in the Final Determination and due to Scottish Water’s costs rising faster than the inflation rate used to set customer bills, total capital expenditure over 2021–27 will be lower than assumed at the time of Final Determination. It is now forecast to be around £4,450 million (in 2017–18 prices), around £400 million less than originally planned. If Scottish Water maintains strong financial and operational performance, this shortfall could reduce to around £300 million.

We are keeping this shortfall under review and will expect Scottish Water to clearly explain the implications for outcomes and customer benefits.

Performance and customer service

In 2024-25, Scottish Water delivered year-on-year improvements and met its targets on the performance measures in place for the 2021-27 regulatory period.

Scottish Water achieved its highest-ever performance in the Outcome Performance Measure which covers nine areas of service performance, performing well in reducing water supply interruptions, and instances of low water pressure. Scottish Water also experienced fewer serious pollution incidents. Favourable weather conditions were a contributing factor in improved performance.

We welcome Scottish Water’s strong performance in these areas; however, both Scottish Water and WICS are concerned about the challenges of maintaining this performance particularly when disruptive weather events are expected to become more frequent. The changing climate is increasing pressure on the services that we all enjoy, and while weather conditions were in Scottish Water’s favour this year, this will not always be the case. There are still areas where Scottish Water can improve further, such as reducing water lost through leakage and instances of sewer flooding. As part of our approach for the 2027-33 regulatory period, we are introducing a broader set of performance measures and expect Scottish Water to make further improvements in these areas.

Capital expenditure and customer charges

The Final Determination set a limit on how much Scottish Water could increase charges over 2021-27 period, allowing average annual rises of up to two per cent above inflation. To help customers during the cost-of-living crisis, Scottish Water chose smaller increases in the first four years. As a result, Scottish Water has collected around £250 million less revenue than expected up to the 2024-25 period. Some of this impact has been offset by lower interest costs and other favourable financial factors, enabling Scottish Water to continue investing broadly in line with expectations, delivering £2,825 million of capital expenditure to 2024-25.

Over the same period, Scottish Water’s costs have risen faster than the inflation rate (Consumer Prices Index) used to set customer bills, while revenue remains lower than expected. As a result, total capital expenditure over 2021-27 is now forecast to be around £4,450 million around £400 million less than originally planned. If Scottish Water maintains strong financial and operational performance, this shortfall could reduce to around £300 million.

We present Scottish Water’s expenditure, revenues and allowances in 2017-18 price base, which was the price base in our SRC21 Final Determination. This allows for like-for-like comparisons.

Investment delivery

Our regulation focuses not only on expenditure, but importantly, on what customers receive from this capital expenditure in terms of tangible deliverables or what we refer to as investment outputs. Investment outputs cover ‘what’ Scottish Water is delivering, such as kilometres of water mains replaced or the number of unsatisfactory intermittent discharges improved or removed. Overall, we welcome that Scottish Water has delivered more outputs than assumed in the investment baseline from 2024; however, there is a small number of areas, such as water treatment work compliance improvements, where it is falling behind.

Furthermore, there are two areas with deadlines beyond the 2021-27 regulatory period that are slipping. These are commitments made as part of both Scottish Water’s Net Zero and Improving Urban Waters Route Maps.

As part of its improving urban waters route map, Scottish Water made commitments to install monitors at sewer overflows by December 2024 and to remove 108 high-priority unsatisfactory intermittent discharges (UIDs) by December 2027. Scottish Water has made good progress installing monitors to increase the coverage of its monitored overflows. However, it has indicated that it is unlikely to deliver all the 108 identified high-priority UIDs and by December 2027 it will instead deliver 64 from the original list and 31 different UIDs which were identified later, resulting in the removal of a total of 95 UIDs. Discussions are ongoing between Scottish Water and SEPA regarding the delivery of the remaining 13 UIDs to reach a total of 108 UIDs by December 2027. There will also be further discussions about the delivery of the UIDs from the original list that were substituted for the 31 different UIDs.

In the second area, Scottish Water has not met its Net Zero Routemap milestone of 60% reduction in operational emissions by 2025. Scottish Water cites the lower than assumed rate at which the electricity grid is reducing its greenhouse gas emissions as a key contributor. Scottish Water explains that it will meet its main target of net zero (which includes operational and embodied carbon emissions) by 2040.

We consider that there is a lesson to be learned from making commitments in separate plans, such as Routemaps, without fully documenting the assumptions and costs of realising the commitments made.

We will continue to closely scrutinise Scottish Waters’ performance in delivering its investment programme, including progress made on both sewer overflows and climate change targets, as well as its Net Zero and Improving Urban Waters Routemaps, over the remainder of the regulatory period.

1. Introduction

1.1 WICS’ role in the Scottish water industry

The Water Industry Commission for Scotland (WICS) is the independent economic regulator of Scottish Water. WICS is a non-departmental public body established through the Water Services Etc. (Scotland) Act 2005. As outlined in the Act, WICS has a statutory duty to promote the interests of customers. Fulfilling these duties involves three main activities:

- Setting the maximum level (known as charge caps) that Scottish Water can raise bills for household customers and wholesale charges for the retailers (known as licensed providers) that serve non-household customers through a process known as the Strategic Review of Charges;

- Monitoring Scottish Water’s performance against the forecasts made at the time of setting charge caps; and

- Overseeing the orderly functioning of the non-household retail market in Scotland to ensure that the retail market delivers good outcomes for customers.

This performance report is an assessment of Scottish Water’s performance over the last financial year in line with the second activity above.

1.2 How WICS performs its role

As noted above, WICS sets the maximum level (known as a charge cap) that Scottish Water can raise bills for household customers and wholesale charges for licensed providers. These charge caps are determined through a multi-stakeholder, transparent and consultative process known as the Strategic Review of Charges. The period covered by the Strategic Review of Charges is known as the regulatory period, which is currently six years. The process ends with WICS confirming these charge caps in a Final Determination before the regulatory control period begins. For example, the Final Determination published in December 2020 set the charge caps to apply over the regulatory control period 2021-22 to 2026-27.

WICS sets charge caps based on its assessment of the lowest reasonable overall cost Scottish Water incurs in delivering the investment priorities set by Scottish Ministers (known as the Ministerial Objectives). These charge caps must also be consistent with the Principles of Charging that Scottish Ministers set. To set these charge caps, WICS forecasts the cash (from revenue and borrowing) that Scottish Water requires to cover the efficient cost of providing water and wastewater services, as well as delivering the investment priorities outlined in Ministerial Objectives.

These forecasts cover three broad categories:

- Sources of cash: covering revenue and net new borrowing from the Scottish Government;

- Uses of cash: covering the efficient cost of running the business (see the section on the different categories of expenditure) and delivering the investment programme; and

- Benefits delivered: covering what customers receive in terms of levels of service performance and tangible deliverables from the investment programme (known as investment outputs or contributions to higher-level outcomes).

Unless otherwise specified, we present Scottish Water’s expenditure, revenues, and allowances in 2017-18 price base, which was the price base in our SRC21 Final Determination. This allows for like-for-like comparisons.

Collectively, WICS refers to these forecasts as ‘the baseline,’ which is typically provided before the regulatory period begins. During the regulatory period, WICS will compare Scottish Water’s reported performance against the forecast values in the baseline and seek to understand any differences. Such monitoring enables WICS to report on whether Scottish Water has achieved the required efficiencies and the investment programme, and ultimately, to hold Scottish Water accountable for its delivery.

The Strategic Review of Charges 2021-2027 (SRC21) adopted a different approach to establish the baseline for service levels and the investment programme.

Service level targets were set using existing service measures, aiming to maintain the high standards of service that most Scottish Water customers receive.

The baseline for the investment programme was based on top-down allowances, with the expectation that further details on the investment programme (e.g. on tangible deliverables) would follow through the Water Industry Investment Group (WIIG). The WIIG would oversee Scottish Water’s development of the investment programme throughout the regulatory period.

Scottish Water provided a detailed forecast of tangible deliverables, referred to as investment outputs, in 2024. These investment outputs cover ‘what’ Scottish Water is delivering, such as kilometres of water mains replaced or the number of unsatisfactory intermittent discharges improved or removed. We cover Scottish Water’s progress in delivering these investment outputs in Section 3.3.

1.3 Structure of this performance report

This report covers three areas:

- Charges and expenditure (Section 2);

- Delivery of the investment programme (Section 3); and

- The delivery of key outcomes for customers and the environment (section 4).

2. Charges and expenditure

This chapter focuses on charges and expenditure, summarising the impact of Scottish Water’s charging decisions over 2021-22 to 2024-25 and financial performance to date on the funding available for capital expenditure.

We present Scottish Water’s expenditure, revenues and allowances in 2017-18 price base, which was the price base in our SRC21 Final Determination. This allows for like-for-like comparisons.

2.1 Revenue & borrowing

The Final Determination set a charge cap of Consumer Prices Index (CPI)+12.6% over the 2021-27 regulatory period, which equates to a cap of CPI+2% on average in each year of the regulatory period. In 2024-25, Scottish Water raised charges by CPI+4.2%. In real terms, these charges were at the same level as in 2020-21 (cumulative increase to 2024-25 was CPI-0.4%).

Scottish Water has delayed increases of charges allowed for in the Final Determination during the 2021-27 regulatory period to respond to the cost-of-living crisis, as shown in Figure 1. This difference means that Scottish Water remains behind the charging profile assumed in the Final Determination.

2021-22 |

2022-23 |

2023-24 |

2024-25 |

2025-26 |

2026-27 |

|

| SRC21 FD | 2.0% | 4.0% | 6.1% | 8.2% | 10.4% | 12.6% |

| Actual | 1.8% | 1.8% | -4.4% | -0.4% | 7.2% |

Primarily, as a result of Scottish Water’s chosen price path (as shown in Figure 1), revenues through the 2021-27 regulatory period have been lower than allowed for in WICS’ Final Determination. In 2024-25, total revenue was £104m lower than allowed for. As shown in Figure 2, the cumulative difference in total revenue (including household revenue, non-household revenue, infrastructure charges and other revenue) is c.£250m.

Revenue (£m, 2017-18 prices) |

2021-22 |

2022-23 |

2023-24 |

2024-25 |

| Actual | £1,172m | £1,131m | £1,128m | £1,202, |

| SRC21 FD | £1,183m | £1,152m | £1,242m | £1,306m |

| Cumulative difference | £11m | £32m | £146m | £249m |

To date, net new borrowing in SRC21 is broadly in line with the levels assumed in our Final Determination. Over the first four years of the period, in nominal terms, Scottish Water debt increased by around £726m, while the Final Determination assumed an increase in debt of £712m (£593m compared to £578m in 2017-18 prices).

2.2 Operating expenditure

OPERATING AND PRIVATE FINANCE INITIATIVE EXPENDITURE (PFI)

In 2024-25, Scottish Water slightly underperformed against the allowance for operating expenditure and PFI expenditure set in the SRC21 Final Determination.

Despite this underperformance, Scottish Water remains below the allowance set in the SRC21 Final Determination for the SRC21 period to date (as shown in Figure 1). This was aided by the receipt of a one-off rates refund of c.£19m during 2023-24, which is equivalent to c.£25m in 2023-24 prices.

2021-22 |

2022-23 |

2023-24 |

2024-25 |

|||||

Actual |

Allowed for in FD |

Actual |

Allowed for in FD |

Actual |

Allowed for in FD |

Actual |

Allowed for in FD |

|

| Operating expenditure (actual) | £349m | £240m | £354m | £386m | ||||

| PFI expenditure (actual) | £154m | £145m | £124m | £127m | ||||

| Operating & PFI expenditure (total) | £503m | £502m | £485m | £497m | £478m | £492m | £513m | £511m |

FINANCING COSTS AND OTHER EXPENDITURE

As observed in previous years of the 2021-27 regulatory period, Scottish Water’s net interest costs are significantly lower than was assumed in the Final Determination. In 2024-25, Scottish Water’s interest costs were c.£35m lower than was assumed in our Final Determination.

This is primarily due to lower-than-expected interest rates and Scottish Water’s ability to refinance embedded debt at the lower prevailing rate. In total over the period 2021-22 to 2024-25, Scottish Water has saved c.£120m in interest costs, with these fluctuations in interest rates being beyond the control of management. Net interest costs are shown in Figure 4.

2021-22 |

2022-23 |

2023-24 |

2024-25 |

|

| Actual | £127m | £111m | £103m | £107m |

| SRC21 FD | £142m | £143m | £143m | £142m |

| Cumulative difference | £14m | £46m | £86m | £121m |

Scottish Water has also experienced favourable movements related to working capital, taxation and other cash flows, totalling around £100m over the period 2021-22 to 2024-25.

2.3 Capital expenditure

During the first four years of the 2021-27 regulatory period, our Final Determination allowed for c.£3,080m of capital expenditure. While consumer price index (CPI) inflation is used for both cost inflation and for setting charges, we apply average inflation over a financial year to costs; however, we set charges relative to inflation in October of the preceding financial year. In this regulatory period, cost inflation rose at a faster pace than the inflation applied to annual bills. This inflation timing difference resulted in a reduction in the available funding for capital expenditure to c. £2,870m.

After an update to the regulatory accounting rules, applicable from 2024-25, the revised capital expenditure allowance is updated to c.£2,850m (as shown in Figure 6). It is against this modelled figure that Scottish Water’s actual capital expenditure is compared in this performance report.

Scottish Water has invested broadly in line with the updated capital expenditure allowance (as shown in Figure 5). This primarily reflects the benefit Scottish Water has gained from lower than forecast financing costs as discussed above.

2021-22 |

2022-23 |

2023-24 |

2024-25 |

|

| Actual | £589m | £669m | £753m | £814m |

| SRC21 FD | £699m | £640m | £732m | £775m |

As shown in Figure 6, to date, Scottish Water has delivered £2,825m capital expenditure in the period to date compared to c.£2,850m allowed for in an updated capital expenditure allowance.

|

|

SRC21 to date |

| Final determination | £3,083m |

| Inflation timing difference | -£215m |

| Regulatory accounting update | -£22m |

| Updated capital expenditure allowance | £2,846m |

| Actual capital expenditure to date | £2,825m |

2.4 Outlook for the full regulatory period

Over the 2021-27 regulatory period, WICS originally allowed for c.£4,850m of capital expenditure. As discussed above and in our previous reports, this allowance has been revised downward to reflect Scottish Water’s cost inflation rising at a faster pace than the inflation applied to annual bills (the inflation timing difference described above).

In addition, Scottish Water’s decision to increase charges at a slower rate than WICS allowed in the Final Determination has further reduced the funds available for capital expenditure. This is partly offset by the unforeseen benefits Scottish Water has experienced because of lower than expected interest costs and other favourable movements in cash.

WICS expects the reduction in revenue and financing costs to continue through the final two years of the 2021-27 regulatory period. This means that WICS expects Scottish Water to deliver around c.£4,450m of capital expenditure over the period, which is around £400m lower than was originally allowed for in the Final Determination. This is summarised in Figure 7.

|

|

Modelled investment allowance in SRC21 |

| Final determination | £4,849m |

| Inflation timing difference | -£261m |

| Regulatory accounting update | -£59m |

| Updated capital expenditure allowance | £4,529m |

| Lower charges | -£251m |

| Interest cost benefit | £177m |

| Expected capital expenditure | £4,455m |

As explained in section 2.2, Scottish Water has generated over £100m as a result of movements in working capital, taxation and other cash flows. If Scottish Water can maintain this outperformance along with the outperformance in operating and PFI expenditure to date, then we estimate that the £400m shortfall in capital expenditure can be reduced to around £300m.

3. Investment delivery

As set out in section 1.2, we set charge caps based on our assessment of the lowest reasonable overall cost of Scottish Water delivering the investment priorities set by Scottish Ministers (known as the Ministerial Objectives). These Objectives are high-level and outcome based. As such, Scottish Water manages its investment programme on a rolling-basis in order to meet these Ministerial Objectives. In initial stages, it develops project options and appraises them. Once a project is appraised and a solution is selected, Scottish Water delivers the project. This chapter focuses on the appraisal process and project delivery.

3.1 Investment appraisal

One of the key performance indicators (KPI 6) from our Corporate Plan relates to assessing how Scottish Water appraises investment. One of our key areas of focus is how Scottish Water is considering the broader non-financial costs and benefits of investment, including carbon emissions and social and environmental impacts.

We have reviewed Scottish Water’s appraisal guidelines and eight recent investment appraisals. The guidelines require Scottish Water to consider the impact of different options on both embodied (which covers emissions associated with capital investment) and operational carbon emissions. Scottish Water uses its Net Present Cost & Carbon Calculator to compare both financial and carbon costs across different investment options. The guidelines also refer to capturing wider benefits at least on a qualitative basis, with a plan to eventually value and incorporate these benefits into the overall economic assessment. We welcome these guidelines as a useful step forward in incorporating carbon and other benefits into appraisals.

Based on the appraisals we have reviewed, we welcome that Scottish Water has incorporated the impact of different options on carbon emissions, providing embodied, operational, and whole-life carbon figures over 60 years. However, there remains scope to improve transparency around how the final numbers are derived. For example, by clearly presenting the input data used, the key assumptions applied (e.g. emission factors), and the calculation methodologies. This aligns with the findings from our review of the sample of projects undertaken for the Strategic Review of Charges 2027-33.

Some of the sample appraisals that we reviewed included a qualitative assessment of wider benefits, such as natural and social capital. We welcome Scottish Water’s intention to value and to incorporate these benefits into its investment appraisals and will look for more evidence of this in future appraisals. As part of this, there may be scope to adopt a more consistent presentation of the wider benefits so that they can be comparable across appraisals.

Overall, while non-financial aspects such as carbon and social outcomes are increasingly recognised within appraisals, the level of detail and consistency could be strengthened further. We welcome Scottish Water’s ongoing efforts to develop guidance for incorporating wider benefits and would like to see this applied more consistently in future appraisals. We intend to comment further on these observations, including the treatment of carbon benefits in the coming years’ reports.

3.2 Project Delivery

SRC21 PROJECT DELIVERY

Once Scottish Water has appraised projects and decides on its preferred solution, the project is added to a Committed List of investment projects. At the time it is added to the Committed List, Scottish Water will confirm its budget and dates the project will reach three delivery milestones: Start-on-site, Acceptance, and Financial Completion. Scottish Water then reports on when each project passes each delivery milestone to industry stakeholders through the Water Industry Investment Group (WIIG).

Scottish Water has a measure showing progress against each delivery milestone at an aggregate level across the investment programme. This measure is known as the Indicator of Progress on Overall Delivery (IPOD) and captures projects with a value of over £1m. The score on this measure was 1,160 points, against a range of 1,079 to 1,208 points as of March 2025. This indicates that, at an overall level, Scottish Water is on track to deliver the projects on the Committed List. Scottish Water was also on track when measuring progress against each of the three delivery milestones outlined above.

The IPOD indicator as of 31 March 2025 was 1,160 points, against a range of 1,079 to 1,208 points. The IPOD score for each of the constituent gates was within the respective target ranges for these gates, as set out below and shown in Figure 8:

- Start-on-site has consistently met the target during the SRC21 period.

- Project acceptance was below the target range starting from Quarter 3 of 2021-22. This indicates that completing projects once they have started on site had consistently taken more time than Scottish Water had forecast initially. However, as of Quarter 3 of 2023-24, Scottish Water has remained within the target range.

- Financial completion has been mostly within the target range during the SRC21 period except for Quarters 2 and 3 of 2023-24; however, it is now back on track and is expected to exceed the upper end of the target range in 2025-26.

We welcome Scottish Water’s good performance on project delivery once projects are added to the Committed List. However, we consider that the governance of Scottish Water claiming points on the IPOD measure could be further strengthened. During the year, we identified that Scottish Water claimed two points on the measure prematurely, relating to upgrading sludge treatment facilities at Londornoch Water Treatment Works. The issue arose as Scottish Water delivered some of the upgrades, but then recognised that the original solution would not provide the intended benefits. Furthermore, Scottish Water considers that a whole site replacement may now be required at Londornoch following the introduction of new water quality parameters in January 2023, meaning that any further investment at the existing site would likely be redundant and therefore not in the interests of customers. Recognising these issues, Scottish Water proposed a change to the project scope to remove one of the upgrades to the sludge treatment facilities.

However, at the time Scottish Water claimed the points on the Indicator of Progress on Delivery measure, the change control form had not been formally approved by the regulators. While the inclusion of these points has not impacted the overall assessment of performance, we are strengthening the change control process and governance of the investment programme to avoid a similar situation happening in the future.

Actual |

|

Forecast | ||||||||||||||||

Months ahead (+) or behind (-) schedule |

Jun21 |

Sep21 |

Dec21 |

Mar22 |

Jun22 |

Sep22 |

Dec22 |

Mar23 |

Jun23 |

Sep23 |

Dec23 |

Mar24 |

Jun24 |

Sep24 |

Dec24 |

Mar25 |

Jun25 |

Sep25 |

| Overall | -0.4 | -0.8 | -0.9 | 0.6 | -1.2 | -2.5 | -3.2 | -1.0 | -2.0 | -1.6 | -1.5 | 0.5 | -0.2 | -0.2 | 0.1 | 0.6 | 1.0 | 1.8 |

| Project start on site | 0.0 | 0.0 | -0.2 | 1.5 | 0.8 | 06 | 0.4 | 1.1 | 1.1 | 0.9 | 0.6 | 0.7 | 0.6 | 1.4 | 0.8 | 0.5 | 0.5 | -1.0 |

| Project acceptance | -0.6 | -1.6 | -3.3 | -3.1 | -5.9 | -7.6 | -9.2 | -6.2 | -6.5 | -3.5 | -3.0 | -1.2 | -2.1 | -2.1 | -1.3 | -0.7 | -0.1 | -0.8 |

| Financial completion of project | -0.6 | 1.1 | 1.0 | 2.7 | 0.7 | -1.1 | -2.5 | -0.5 | -2.8 | -3.5 | -3.7 | 2.4 | 1.0 | 1.1 | 0.8 | 1.7 | 2.3 | 4.3 |

| Tramlines (+/-3 months) | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 |

| 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | |

COMPLETION INVESTMENT

Completion investment relates to investment included in the investment programme for the 2015-21 regulatory period but is still to be delivered. There are two categories of SRC15 completion projects:

- Delayed Projects – projects that were expected to complete by the end of SRC15 but were impacted by Covid-19, re-optioneering, scope change, construction risk and third-party risk.

- Planned Projects – projects that commenced in SRC15 but were always expected to complete during SR21.

Delayed |

Planned |

|

| Total remaining projects at 31 March 2021 | 86 | 57 |

| March 2021 forecast for completed projects by 31 March 2025 | 86 | 57 |

| Actual completed projects by 31 March 2025 | 71 | 52 |

| Actual less forecast number of projects to be completed by 31 March 2025 | -15 | -5 |

The investment programme from the 2015-21 regulatory period that remains to be delivered is behind the March 2021 forecast. Scottish Water explains that this is due to a combination of changes in scope and third-party challenges on already complex projects. A total of 15 “Delayed projects” and 5 “Planned projects” are still to achieve project acceptance. The remaining completion investment represents under 2% of the total SRC15 programme.

Scottish Water holds regular bilateral meetings with DWQR and SEPA, where projects of specific interest to these stakeholders, including completion projects, are reviewed to give detailed updates on progress and answer any queries. Progress on these projects is also examined through the WIIG.

3.3 Output delivery

Our regulation focuses not only on expenditure, but importantly, on what customers receive from the capital expenditure in terms of tangible deliverables or what we refer to as investment outputs. These investment outputs cover ‘what’ Scottish Water is delivering, such as kilometres of water mains replaced or the number of unsatisfactory intermittent discharges improved or removed.

Scottish Water has established a forecast for investment projects and outputs in March 2024 (referred to as IPS24.1). These forecasts show how Scottish Water proposes to meet the Ministerial Objectives at that point in time, recognising that there may be changes to investment priorities to respond to developing or new investment needs. This is the forecast that we will use for measuring Scottish Water’s progress on delivering investment outputs for the remainder of the 2021-27 regulatory period.

Over the period 2021-22 to 2024-25, Scottish Water has delivered more outputs overall than it forecast in the baseline across over 180 output categories. Of these, for enhancement and growth investment, at an aggregate level, Scottish Water has delivered 118% of outputs by 31 March 2025.

Out of 82 enhancement and growth output categories, Scottish Water reports that:

- 34 are either in line with or above the forecast number of outputs;

- 22 are below the forecast number of outputs; and

- 26 had 0 outputs forecast for 2021-25 and 0 outputs delivered.

Table 2 provides a summary of the 22 that are below the forecast number of outputs. Of these, Scottish Water expects to recover its position and meet the forecast by the end of the regulatory period 2026-27 for 11 of them.

Output description |

2021-2025 Outputs |

||

Delivered |

Baseline |

% |

|

Outputs categories forecast to recover to on-track by March 2027 |

|||

| Increase in Part 4 capacity to meet local growth requirements | 38718 | 39235 | 99% |

| Number of Transformation initiatives implemented | 65 | 66 | 98% |

| Additional Capacity enabled from strategic wastewater network reinforcement | 32330 | 33068 | 98% |

| Number of properties with temporary internal flood prevention measures | 28 | 29 | 97% |

| Number of service relocations - waste | 13 | 16 | 81% |

| Number of carbon capture sites established or supported | 4 | 5 | 80% |

| Number of Waste Supply Zones with improved resilience | 8 | 11 | 73% |

| Additional Capacity enabled from strategic water network reinforcement | 28550 | 47019 | 61% |

| Number of treated water storage operability (by-pass) interventions | 51 | 119 | 43% |

| Number of properties with lead sampling and risk assessment completed | 0 | 4700 | 0% |

| Number of single supply standard products developed | 0 | 1 | 0% |

Outputs categories forecast to remain off-track by March 2027 |

|||

| Number of properties removed from external flooding at risk register | 112 | 115 | 97% |

| Number of lead communication pipes replaced | 7988 | 8423 | 95% |

| Length of new or enhanced distribution mains | 1500 | 1870 | 80% |

| Number of studies complete | 321 | 466 | 69% |

| Reduction in energy usage through improved energy efficiency | 10 | 19 | 52% |

| Number of sites with enhanced metals removal | 1 | 2 | 50% |

| Number of Lighthouse projects delivered | 2 | 4 | 50% |

| Number of unsatisfactory intermittent discharges (UIDs) improved or removed for water quality | 1 | 2 | 50% |

| Number of WTW with increased capacity | 1 | 2 | 50% |

| Number of WTW sites made compliant with standards | 32 | 118 | 27% |

| Number of new top-up-from-the-tap points | 0 | 50 | 0% |

We can only determine whether Scottish Water has met the Ministerial Objectives at the end of the regulatory period, as Scottish Water may decide to reprofile investment over the period or reallocate investment in response to developing or new investment needs. However, our analysis shows there are areas where Scottish Water expects to be off track by the end of the regulatory period, including the number of unsatisfactory intermittent discharges improved or removed for water quality, the number of water treatment works made compliant with standards and a reduction in energy usage. We will engage further with Scottish Water and its regulators to understand these differences further and also require Scottish Water to explain what it has delivered in place of the investment where it has reported a shortfall in outputs by the end of the period.

Looking forward to the 2027-33 regulatory period, we are also making changes to the governance of the rolling investment programme to strengthen the change control process to gain better understanding among stakeholders on the in-period investment decisions.

We now cover two aspects of the Ministerial Objectives in more detail:

- Environment; and

- Climate change, adaptation and mitigation.

ENVIRONMENT

The Ministerial Objectives related to environmental performance include requirements that:

“(2) Scottish Water must prepare and implement delivery plans throughout the 2021-27 period which set out how improvements to its water and sewerage infrastructure are expected to contribute effectively to the RBMP objectives.

(3) Scottish Water must provide regular updates on the progress it has made towards delivering its obligations in respect of river basin management plans.”

To meet this requirement, Scottish Water prepared an Improving Urban Water Routemap in December 2021 for implementation by 31 December 2027. This routemap was published nine months into the 2021-27 regulatory period and was not considered at the time of the Final Determination but Scottish Water incorporated it into future investment plans through the rolling-investment programme.

As part of its Improving Urban Waters Routemap, Scottish Water has made commitments to:

- Improve water quality by addressing the high priority discharges impacting water quality and causing sewage related debris in support of Scotland’s River Basin Management Planning Objectives;

- Increase monitoring and reporting to cover all combined sewer overflows (CSOs) that discharge into the highest priority waters;

- Significantly reduce sewer related debris in the environment; and

- Reduce spills from the sewer network.

The Routemap and the subsequent annual updates set out tangible commitments relating to these areas, including:

- Installing monitoring on network and treatment works CSOs discharging to the highest priority waters (c. 1,000 CSOs);

- Publishing near-real-time spill data for all monitored CSOs by the end of December 2024; and

- Developing solutions for CSOs confirmed as being high priority Unsatisfactory Intermittent Discharges (UIDs) for delivery by December 2027.

Scottish Water anticipated that the cost of delivering these activities was approximately £150m to £200m and would require rephasing or reprioritisation of other Scottish Water activities planned for the 2021-27 regulatory period.

In relation to the first two areas, we note that Scottish Water installed 1,002 new Event Duration Monitors by December 2024 and it plans to increase the number of monitors in the future. It has also launched a near-real-time map of overflows in December 2024. As such, we welcome the fact that Scottish Water has met the two commitments above.

In relation to the third area above, in its first annual update of the Improving Urban Waters Routemap, Scottish Water confirmed that 108 high priority UIDs were identified and agreed with SEPA, with solutions to these promised by December 2027.

While the deadline for the removal of these UIDs is December 2027, we note an increased risk of slippage in this area of the investment programme. This recognises that Scottish Water is currently off track in removing the UIDs compared to its original forecasts (as shown in Table 2). Furthermore, as of September 2025, Scottish Water identified that it is unlikely to deliver all 108 identified UIDs and will instead deliver 64 UIDs from the original list and 31 different UIDs which were not on that list by December 2027, resulting in the removal of 95 UIDs in total. Discussions are ongoing between Scottish Water and SEPA regarding the delivery of the 13 UIDs to achieve an overall removal of at least 108 UIDs, as well as the removal of UIDs from the original list that were substituted in favour of the 31 different UIDs.

We consider that there is a lesson to be learned from making commitments in separate plans, such as Routemaps without fully documenting the assumptions and costs of realising the commitments made. While maintaining the flexibility of the rolling investment programme, we expect Scottish Water to establish a baseline against which it can be held accountable. In certain circumstances, such as when regulators or legislation introduce new requirements, there may be a need for a change to the baseline. We will introduce a change control process to enable industry stakeholders to understand the impact of the proposed changes on the investment programme and performance in other areas.

We welcome that Scottish Water has committed to providing quarterly updates on progress towards delivering the UID programme to industry stakeholders through the Water Industry Investment Group (WIIG).

CLIMATE CHANGE, ADAPTATION AND MITIGATION

The Ministerial Objectives related to climate change mitigation include requirements that:

“(1) Scottish Water must…(c) make substantive progress in the 2021-27 period towards the climate change targets, and ensure it is on an appropriate trajectory to meet or exceed those targets.”

“Climate change targets mean the commitment by Scottish Water to:

- increase the renewable electricity generated or hosted on its land and assets to 300% of its annual usage by 2030, and

- achieve net zero emissions by 2040”

This target of net zero emissions by 2040 applies to operational emissions and all emissions associated with the capital investment programme. As a stepping stone on its journey towards net zero, Scottish Water's published a Net Zero Routemap establishing interim milestones to reduce operational emissions by at least 60% (from the 2007 baseline) by 2025 and by at least 75% by 2030. The 2030 milestone was set to align with the previous Scotland-wide target, which has been superseded by a carbon budget approach to setting climate targets.

Figure 9 shows Scottish Water’s progress in reducing its operational carbon emissions compared to the 2006-07 baseline. In 2024-25, Scottish Water has reduced its net operational carbon emissions by around 52% compared to the 2006-07 baseline.

This falls short of the interim milestone established in Scottish Water’s Net Zero Routemap to reduce operational emissions by at least 60% (from the 2007 baseline) by 2025. Scottish Water attributed the shortfall to the UK electricity grid “greening” (rate at which the electricity grid is reducing its greenhouse gas emissions) more slowly than expected, and that the milestone would have been met if greening had followed the UK Government’s initial prediction. On 1 October, Scottish Water published the 2024-25 annual update to its net zero emissions routemap. This update explains that Scottish Water remains on track to deliver net zero before 2040, and that operational net zero is expected to be achieved in the mid-2030s.

|

We will continue to engage with Scottish Water, the Scottish Government and other stakeholders on monitoring Scottish Water’s progress towards meeting its climate change targets.

4. The delivery of key outcomes for customers and the environment

This chapter focuses on the delivery of key outcomes to customers and the environment. In 2024-25, Scottish Water delivered year-on-year improvements and met its targets on the performance measures in place for the 2021-27 regulatory period.

4.1 Assessment against targets for 2024-25

CUSTOMER SERVICE

Scottish Water measures customer service through a measure known as the customer experience measure (CEM), established for household customers in 2014-15. The CEM covers both customer satisfaction and customer complaints. There are now separate CEM measures in place for households, non-households (i.e. licensed providers and business end-users) and developers.

The scores for these measures are shown against the annual targets Figure 10 (households), Figure 11 (non-households) and Figure 12 (developers). As shown, Scottish Water has maintained its performance on its household and non-household CEMs and improved its performance on the developer CEM.

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

| Household CEM | 86.0 | 86.4 | 86.6 | 87.3 |

| Target (lower end) | 85.0 | 85.0 | 85.0 | 85.0 |

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

| Non-household CEM | 87.2 | 86.7 | 89.7 | 89.3 |

| Target (lower end) | 85.4 | 85.4 | 85.4 | 86.0 |

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

| Developer CEM | 86.9 | 77.1 | 75.9 | 82.9 |

| Target (lower end) | 76.5 | 76.5 | 76.5 | 78.3 |

SERVICE PERFORMANCE

Scottish Water measures its service performance across nine measures in total (as shown in Table 3), covering the water service, wastewater service, and the impact of these services on the water environment. Performance on these nine measures is combined into an overall measure known as the outcome performance assessment (OPA), introduced in Scotland in 2002-03. Updates to the measure's composition were made in 2010-11 and 2021-22.

In 2024-25, Scottish Water reported a score of 416 (92% of points available) against a target range of 395 – 410 points. This is the highest score reported on the measure and above the higher threshold of the target range, as shown in Figure 13.

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

| OPA | 398 | 401 | 402 | 416 |

| Target range - low | 395 | 395 | 395 | 3995 |

| Target range - high | 410 | 410 | 410 | 410 |

There were improvements across eight out of nine measures, with only a slight decrease in the ninth measure total pollution incidents (-0.4 points lower than in 2023-24). The improvements in the reporting year are in part due to favourable weather conditions and a decrease in serious pollution incidents. The reduced number of serious pollution incidents gave a 7-point increase in the score, accounting for half of the total change compared to 2023-24. Table 3 performance across all measures.

Drinking water quality

Drinking water quality remained high, with 99.9% of water samples in 2024 compliant with parameters.

The Drinking Water Quality Regulator (DWQR) publishes its report on Scottish Water’s performance covering each calendar year. The most recent report covering calendar year 2024 was published in September 2025. The report confirms that “compliance with regulatory standards remains extremely high, offering considerable reassurance about the safety of drinking water”. However, DWQR expressed concern about “the frequency of short-lived, yet largely avoidable, incidents” which they had to investigate. It also notes “that several preventable incidents resulted in the supply of discoloured water to large numbers of consumers.” DWQR’s full report is available on its website. We are aware that operational incidents impacting customers may not affect the overall compliance score in the OPA and are working with DWQR on how we can further collaborate to measure Scottish Water’s performance in this area.

Indicator |

Definition |

Performance range to achieve minimum and maximum score |

2021-22 |

2022-23 |

2023-24 |

2024-25 |

| Total Drinking Water Quality | Percentage of water samples that comply with parameters | 99.522% - 99.978% | 99.936% | 99.929% | 99.923% | 9.932% |

| Interruptions to supply | Percentage of connected properties experiencing unplanned interruptions | 1.768% - 0.057% | 0.34% | 0.20% | 0.23% | 0.18% |

| Poor pressure | Properties per 10,000 water connections subject to inadequate water pressure | 11.947% - 0.165% | 0.163% | 0.169% | 0.139% | 0.078% |

| Leakage | Actual leakage (Ml/d) | 1046.16 - 400 | 458.39 | 453.71 | 461.84 | 453.56 |

| Internal sewer flooding | Number per 10,000 connected wastewater properties suffering internal sewer flooding caused by overloading and other causes | 16.72 - 0.4 | 1.55 | 1.37 | 1.43 | 1.04 |

| EPIs (category 1 & 2) | Weighted number of water and wastewater environmental pollution incidents (category 1 and 2) incidents per 10,000km of sewer network | 4.226 - 0.149 | 1.119 | 1.291 | 1.006 | 0.362 |

| EPIs (category 3) | Weighted number of water and wastewater environmental pollution incidents (category 3) incidents per 10,000km of sewer network | 1.225 - 0.1013 | 0.5205 | 0.3781 | 0.3620 | 0.3877 |

| Wastewater compliance | Number of non-compliant wastewater treatment works out of 1428 treatment works | 131.3 - 6.5 | 20 | 22 | 22 | 18 |

| Sludge compliance | % of sludge disposed of satisfactorily | 98.22% - 100% | 100% | 100% | 100% | 100% |

4.2 Comparisons to English and Welsh water companies

While there are different water quality and environment regulations in Scotland than in England and Wales, it is still possible to compare Scottish Water’s performance to that of other companies in England and Wales for a subset of measures. These are:

- Leakage

- Per capita consumption

- Water supply interruptions

- Serious pollution incidents

- Total pollution incidents per 10,000km of sewer length

- Discharge permit compliance

- Internal sewer flooding

Table 4 shows Scottish Water’s performance across these measures in 2024-25 and how it compares to performance of water and wastewater companies in England and Wales.

Measure |

Scottish Water |

England and Wales range |

||||

min |

median |

weighted average |

max |

|||

| Leakage (leakage as percentage of distribution input) | 25% | 15% | 20% | 20% | 27% | |

| Per capita consumption (lpd) | Overall | - | 124 | 131 | 135 | 152 |

| Unmeasured | 178 | 141 | 163 | 162 | 304 | |

| Water supply interruption (average minutes lost) | 00:10:36 | 00:04:34 | 00:10:00 | 00:24:03 | 02:21:50 | |

| Serious pollution incidents | 4 | 0 | 4 | 10 | 33 | |

| Pollution incidents per 10,000km of sewer length | 36.8 | 28.9 | 43. | 45.9 | 108.4 | |

| Discharge permit compliance | 96.90 | 97.21 | 98.69 | 98.81 | 100.00 | |

| Internal sewer flooding | 1.05 | 0.63 | 1.36 | 1.80 | 3.48 | |

Scottish Water is performing better than the average of the English and Welsh companies on the following measures:

- Water supply interruptions;

- Pollution incidents;

- Internal sewer flooding.

However, its performance is below the average of English and Welsh companies in terms of leakage reduction, per capita consumption, and discharge permit compliance. Looking ahead, we are introducing a broader set of performance measures into our performance framework to ensure that Scottish Water is continuously delivering better service for customers when compared to peer water companies.

5. Looking ahead

Scottish Water and the broader industry face several challenges, including mitigating and adapting

to the impacts of a changing climate, managing the risks associated with an ageing asset base, and

meeting stakeholder and societal expectations for drinking water quality and environmental

protection. There are also opportunities, such as enhancing natural and social capital.

Over the coming years, we will be monitoring how Scottish Water addresses these challenges and maintains high levels of service. In the strategic review of charges 2027-33 (SRC27), we will require Scottish Water to report their performance across a broader set of measures than in the current period. We will also introduce stretching targets for these measures at the beginning of the period. We will look to Scottish Water to make improvements in several areas, including reducing leakage and reducing sewer flooding.

In December 2024, we published our Final Methodology, which outlined our approach for the SRC27 covering years 2027-28 to 2032-33. We will review Scottish Water’s Business Plan in February 2026 and will set charge caps based on our assessment of the lowest reasonable overall cost incurred by Scottish Water in delivering the Ministerial Objectives, consistent with the Principles of Charging for the industry. To set these charge caps, we will review Scottish Water’s plan for efficiency and effectiveness and estimate the cash it will require over the six-year period to deliver the investment required to meet these Objectives.

We will consult on our Draft Determination in June 2026 and publish our Final Determination in October 2026.

6. Conclusion

Overall, we conclude that Scottish Water maintained its strong performance in service levels, reporting its highest-ever performance across key aspects of service delivery. Scottish Water continues to deliver high levels of investment, despite not raising bills to the maximum level available. However, we are starting to observe a slippage in a small number of areas where Scottish Water has made commitments beyond the 2021-27 regulatory period, including in relation to the removal of unsatisfactory intermittent discharges and climate change targets. We continue to monitor these areas carefully, working closely with other industry stakeholders.